What is CAGR?

Compound annual growth rate (CAGR) is the average rate of growth of an investment over a specific time period that assumes “compounding” ( reinvesting profits at each interval within that time span) — that smoothes out how the growth of the company looks into a single number as if the growth had happened steadily each year over that time period.

🤔 Understanding CAGR

Compound Annual Growth Rate (CAGR) is typically used as a tool for evaluating the performance of a stock or an investment over a set amount of time in the past. It’s one way you could calculate the growth rate of a stock or a venture capitalist may evaluate the performance of a startup — it’s the average of how much an investment gains or loses on an annual (or other regular) basis. To calculate it, take the ending value of the investment, divided by the beginning value, raised to the power of the reciprocal of the time duration of the investment, and then subtract 1. It assumes that any profits an investor gains are reinvested at each interval within the determined time period (aka “compounding”). In other words, it’s the hypothetical constant growth rate that would be required for compound interest to help transform the starting value of an investment to a future value in a specific amount of time. It’s important to note: CAGR calculates a hypothetical constant growth rate, but it never guarantees that rate will materialize in real life.

We’ll look at how compound annual growth rate can be a helpful tool in assessing the performance of an investment over a past period of time, such as a stock.

Assessing a stock’s performance:

Let’s say an investor bought 200 shares of a hypothetical stock for $100 per share in January 2015, for an initial value of $20,000. After four years, in January 2019, the stock has risen to $150 per share, and the investor’s investment is worth $30,000.

To calculate the compound annual growth rate, we need the ending balance, the beginning balance, and the time period, in this case, the number of years.

The ending value of the investment, divided by the beginning value, raised to the power of the reciprocal of the time duration of the investment, which in this case, is 4 years:

(($30,000 / $20,000) ^ ¼ )

Now we subtract 1, and multiply by 100% to see its value as a percentage:

($30,000 / $20,000) ^ ¼ ) - 1 = .1066

.1066 x 100% = 10.66%

The compound annual growth rate for this stock is 10.66%.

A key note – CAGR can be negative, too. This happens when the ending value of the stock is lower than the beginning of the value of the stock. A hypothetical example: Let’s say our 200 shares in the stock above declined to $50 per share in January 2019, down from $100 per share in January 2015. This stock’s CAGR would be:

($50 x 200)/ ($100 x 200) ^ ¼ - 1 = -0.875

These examples are hypothetical and do not reflect the actual performance of any investment.

Takeaway

Compound annual growth rate is kind of like the average historical performance of a sports player over multiple seasons of his or her career...

It measures the performance of an investment over a set amount of time, assuming that any profits from that investment were re-invested (aka compounding). It’s different than the average annual growth rate, which more simply measures the average change in revenue or profit of an investment from one year (or other discrete period of time) to the next. Ultimately, it takes all those historical growth numbers and turns them into a single growth statistic that’s easy to compare with other investments.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

- How is CAGR calculated?

- How can CAGR be used to assess a stock’s performance?

- How can CAGR be used to help an investor determine how much she needs to invest to reach an investment goal?

- How is CAGR different from an average annual growth rate?

- What are the limitations of CAGR?

- How is CAGR different from an internal rate of return?

- What is compound interest?

How is CAGR calculated?

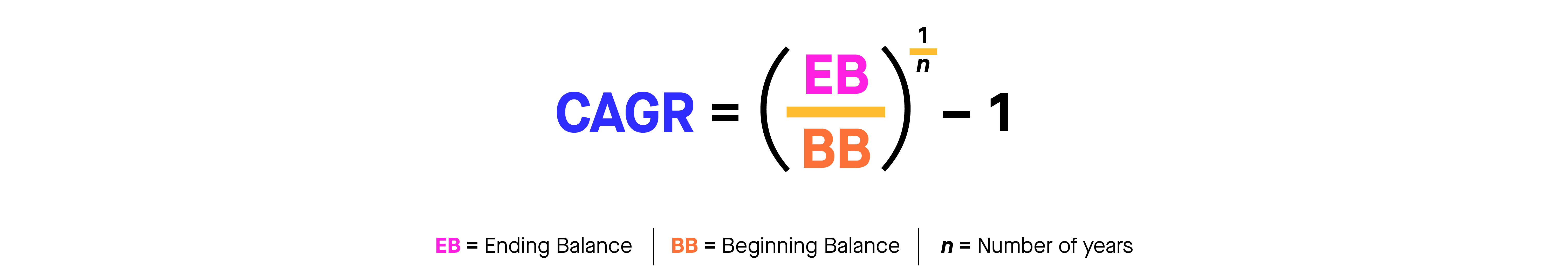

CAGR is calculated by dividing the end value of an investment by its initial value, and then raising this value to the reciprocal of the number of periods the investment is held, which could be months, years, etc. Finally, you subtract 1. To see CAGR as a percentage, you’d multiple this value by 100%.

If an investment such as a stock paid dividends to the investor during this time period, any dividends would be accounted for in the end value.

How can CAGR be used to assess a stock’s performance?

One of the key applications of CAGR is as a tool for assessing the performance of a stock over a period of time in the past.

Let’s say an investor bought 200 shares of a hypothetical stock for $100 per share in January 2015, for an initial value of $20,000. After four years, in January 2019, the stock has risen to $150 per share, and the investor’s investment is worth $30,000.

To calculate the compound annual growth rate, we need the ending balance, the beginning balance, and the time period, in this case, the number of years.

The ending value of the investment, divided by the beginning value, raised to the power of the reciprocal of the time duration of the investment, which in this case, is 4 years:

(($30,000 / $20,000) ^ ¼ )

Now we subtract 1, and multiply by 100% to see its value as a percentage:

($30,000 / $20,000) ^ ¼ ) - 1 = .1066

.1066 x 100% = 10.66%

The compound annual growth rate for this stock is 10.66%.

Once an investor has a stock’s CAGR over a specific time period, he or she could use the CAGR to compare that stock’s performance to their other investments, for example, or to the performance of stock indexes or other investment benchmarks.

How can CAGR be used to help an investor determine how much she needs to invest to reach an investment goal?

In addition to being a tool for measuring the performance of an investment over a period of time in the past, CAGR can also be used to help an investor determine how much he or she should invest in the present to reach a certain investment goal over time.

Let’s say an investor wants to determine what average CAGR, or rate of return, they’d need to ensure that the $20,000 they can invest today for their oldest child’s education can translate to $60,000 in 10 years, assuming any profits are reinvested at the end of each year of the investment’s lifespan.

The annual growth rate the couple would need is:

($40,000/ $20,000) ^ 1/10 - 1 = 0.866

0.866 x 100% = 8.66%

To ensure the couple’s investment is able to reach their goal of $60,000 in 10 years, they may consider investing more funds upfront in order to account for the fact that they won’t be guaranteed to reach $60,000 in 10 years.

Keep in mind this a hypothetical example and does not reflect the performance of any investment. Investing involves risk - aka you could lose your money.

How is CAGR different from an average annual growth rate?

CAGR measures the growth rate of an investment over a series of time intervals (and assumes compounding over that period). This can be a retail investor measuring the return on a stock or it can be a venture capitalist measuring the growth rate of a potential investment. By contrast, the average annual growth rate (AAGR) measures the average increase in the value of an investment or asset over the period of a year - math lovers call it the arithmetic mean of a series of growth rates.

AAGR is calculated by taking the sum of average growth rates in a series of periods, divided by the total number of periods. In other words, it’s the average of a series of periodic return growth rates. It’s key to note that AAGR must be calculated using periods of equal length, whether that’s weeks, months, or years, etc.

AAGR is standard for measuring the average value of returns over several time periods. Mutual funds, for example, typically report AAGRs in their prospectuses, and brokerage firms usually disclose this value in their financial statements.

While AAGR can help an investor understand how an investment has performed one year to the next, it doesn’t give investors a good sense of how much an investment may have dropped in value during the time period.

For example, if a fund started at $10,000, and fell to $7,500 by the end of the first year, it has fallen 25% in that year. If in year 2, the fund grew back to $10,000, it has grown 33% that year ($10,000 - $7,500 / $7,500).

The average annual growth rate would be 4% = ((-25% + 33%) / 2)

Meanwhile, the CAGR would be 0%: ($10,000/$10,000) ^ ½ - 1

In this case, CAGR does a clearer job indicating that an investment dropped in value over the series of time periods, while AAGR may make it appear that the investment only increased in value during this time period, which is not the case.

What are the limitations of CAGR?

While CAGR can be a simple way to help measure the past performance of a stock without a complex spreadsheet, it has its limitations. Because CAGR represents a hypothetical constant growth rate for a period of time, it can smooth over erratic jumps or dips in the value of an investment within that time period. In the course of five years, for example, a stock or other investment that had risen overall may have dipped dramatically in value between year 3 and year 4, or vice versa.

This is important to note because most investments have uneven returns over time. Because CAGR only compares the final value of an investment over a time period to its initial value, it doesn’t always give an investor a very good indication of how the stock or investment was actually performing over time within each interval of time, which could be a month, quarter, or year, for example. It’s important that investors don’t let CAGR lead them to assume returns will be more predictable than they are.

You often also see CAGR used to help measure the revenue growth of private companies. Annual revenues of a 6-year-old startup might not fluctuate on a daily basis as much as a stock in the market moves — so CAGR can be a helpful tool that a venture investor might use to compare growth between a couple of different investment options.

It’s also important to note that while CAGR can be used to compare how one stock compares to another in a peer group, or against a stock market index, it can’t be relied on as a signal for investment risk, or as an indicator of how a stock will perform in the future. CAGR also does not account for funds that might be added or removed over the period being measured.

How is CAGR different from an internal rate of return?

The internal rate of return (IRR) is typically used by companies in budgeting to estimate the profitability of potential investments. While CAGR is typically used as a tool for helping assess the past performance of an investment, or determining the interest rate an investment would require to reach an end value over a specific period of time, IRR is typically used for a company’s internal planning future growth and expansion.

What is compound interest?

Compound interest is the phenomenon in which gains made on an investment are reinvested with the original investment. When this happens, future interest is made not only from the initial investment, but also from the interest that was reinvested, which can lead to a snowball effect over time. In other words, it’s interest made on an investment, plus interest made on previously accumulated interest. For dividend-doling stocks, this may include dividends the stock paid out during the year, which can be reinvested by the investor.

Compounding interest is a key principle in longer-term investing – It also helps explain a key aspect of compound annual growth rate (CAGR), which shows the average growth rate of an investment over a period of time, assuming that any interest from that investment was reinvested at each interval within that time period.

If you’re looking for a compound interest calculator, you can find one on the Securities and Exchange Commission’s Investor.gov site: https://www.investor.gov/additional-resources/free-financial-planning-tools/compound-interest-calculator

Please be advised that by clicking a third-party URL or hyperlink, you’ll be accessing a third-party website. Robinhood Financial LLC is not implying that any monitoring is being done by Robinhood Financial LLC of any information contained on the third-party website. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Nor do we guarantee their accuracy and completeness.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.