What are Financial Statements?

Financial statements are a collection of reports that companies use to share important information about their financial situation.

🤔 Understanding financial statements

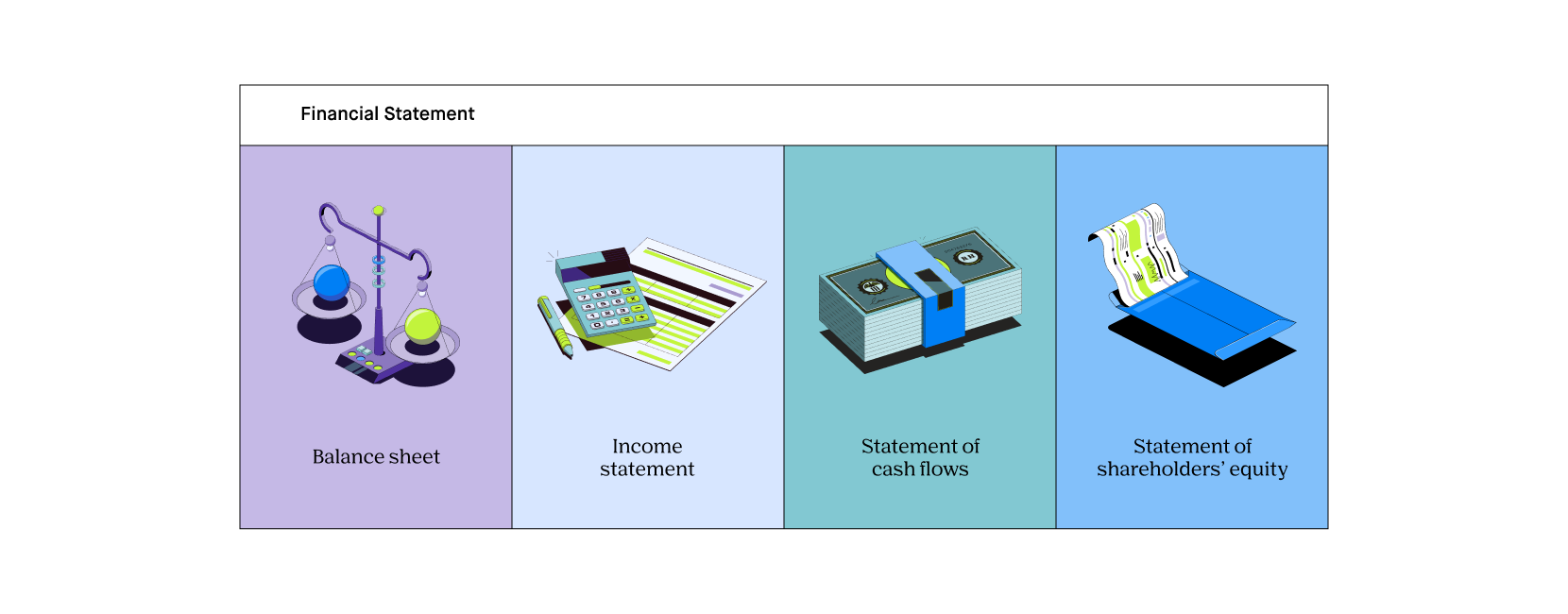

Financial statements convey important information about a company’s operations and performance in written form. There are many types of financial statements that companies create, and they can vary among private and public companies. Publicly-traded companies (meaning those that sell shares on the stock market) are required to report to investors and the government certain financial information. They have to share their financial situation and activities using several different reports called financial statements. These statements convey essential information about the financial health of a company. Potential investors use these statements when making decisions about their investment portfolio, and government agencies use these statements to ensure the company is following legal guidelines. Private companies often create financial statements as well, but they don’t have to share them with the public. Balance sheets, income statements, cash flow statements, and statements of shareholders’ equity are the four financial statements companies file.

A fictional company, Stan’s Flooring, started selling stock in their firm for the first time this year (this is called an IPO, or initial public offering). Now that they’re a public company, Stan’s Flooring has to file certain financial statements each quarter. One of those statements is a balance sheet, which shares a company’s assets, liabilities, and shareholders’ equity. This is a summary of everything Stan’s company has of value and everything they owe.

Takeaway

Financial statements are like a photo album…

A photo album shows you what happened over the past year — What your family did, the vacations you took, and so on. Think of it as your annual summary. A financial statement is similar — Together, they make up a complete summary of your year, such as where you spent and made money, the assets you had, and the debts you still have to pay.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

What are the types of financial statements?

There are four primary financial statements that companies file: the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity. Each of these statements provides different important information to stakeholders and managers. The information on each of these statements combines to make up the company’s complete financial picture.

Balance sheet

A balance sheet is a summary of three primary components of a company’s financial position: its assets, its liabilities, and its shareholders’ equity.

A company’s assets are anything that it owns that has value. It includes current assets, meaning cash or anything that can be converted to cash within one year. It also includes non-current assets, which is anything that you can’t easily convert to cash but still has value — Think of land, buildings, and equipment.

A company’s liabilities are its debts. These include short-term obligations that it expects to pay off within one year. Some examples of short term debts would be payroll owed to employees or money owed to a supplier. Liabilities also include long-term debts that the company will be paying off for longer than one year. An example of this type of debt would be the mortgage it has on a building.

Finally, balance sheets include shareholders’ equity, which is the amount of the company that shareholders own. It’s equal to the difference between a company’s assets and its liabilities.

The purpose of a balance sheet is to tell investors how a company is paying for its assets — either through debt or through the owner’s equity. Investors can use the debt-to-equity ratio to evaluate the health of the company and how efficiently it uses its resources.

To create a balance sheet for your company, list on one side your company’s assets (broken down into current assets and noncurrent assets). On the other side of the sheet, list your company’s liabilities (again, broken down into current and noncurrent) and the shareholders’ equity. The total sum of your assets should always equal the total sum of your liabilities and equity.

Income statement

An income statement (aka a profit and loss statement) is a summary of a company’s total revenue and expenses for a specific period of time. The company uses those two figures to determine its profit for that period by subtracting its costs from its revenue.

The first component of an income statement is revenue. The revenue is the money a company made by selling its core products and services. The company also accounts for any money it made from anything that is not its primary product or service — This is its gains or non-operating revenue. Non-operating revenue could include interest income or money earned from a one-time sale of real estate.

A company’s expenses are the money it spent doing business. It includes administrative and operating costs such as payroll, rent, and utilities, as well as the cost of goods sold. This also includes secondary expenses such as debt or interest payments.

The purpose of an income statement is to show how profitable a company was over a specific period and how efficiently it used its money. Income statements help potential investors see whether a particular stock will be a good investment. They are also valuable for the company to determine where it should be making changes and where it might be losing money.

To prepare an income statement, you’ll need to include your product revenue and expenses, your gross profit, your operating expenses and income, the amount you owe in taxes, and the final next income. If you paid dividends to shareholders or there are earnings available to shareholders, you should report those numbers.

Cash flow statement

A cash flow statement (aka statement of cash flows) shows a company’s incoming and outgoing cash flow over a specific period. It only includes money that actually exchanged hands — it doesn’t include money that people owe the company, but they haven’t paid, or debts the company owes but hasn’t settled yet. There are three different types of cash flow: operating cash flow, investing cash flow, and financing cash flow.

Operating cash flow is any money going in or out relating to the core function of the business. This cash flow would be the money a company makes by selling its core product or service, as well as the money it spent to produce it.

Investing cash flow is any money it spent on investments in company growth. For a company, this might include purchases of property or equipment or any money it made from selling those items.

Financing cash flow is money related to shareholders’ equity. It includes money coming in from the sale of stocks and bonds, and money the company pays to shareholders such as dividends.

A cash flow statement also shows a company’s free cash flow, which is what’s left after you account for cash coming in and cash going out. Free cash flow is essentially the money that’s available for the company to either spend or return to shareholders.

Statement of shareholders' equity

The statement of shareholders’ equity (aka the statement of retained earnings) summarizes any changes in equity over a specific period. First, it contains the amount of stock the company sold during the reporting period. This component includes the sale of both common stock and preferred stock (a special kind of stock that offers a higher claim on earnings and dividends). The statement also shows how much ownership the company purchased back from shareholders (this is known as treasury stock).

The statement of shareholders’ equity shows how much money the company has paid out to investors in the form of dividends. Likewise, it shows the company’s retained earnings, which is profits that the company has brought in but has not yet distributed to shareholders.

This statement can be particularly beneficial for investors because — while all of the statements are some indication of the company’s financial health — this statement shows explicitly the money that went to shareholders.

What are the limitations of financial statements?

Financial statements provide a lot of information to analysts and potential investors and can be incredibly valuable when it comes to making investment decisions. But they aren’t without their faults.

First, as with anything, there is room for human judgment and error. The financial statements are prepared by individual people, and they bring their own predispositions to the job. One person might account for certain components differently than someone else would. In addition to human error, it’s not outside the realm of possibility that intentional fraud would take place. Deliberate fraud is what happened in the famous case of Enron, where executives lied about the company’s profits when reporting them to shareholders.

Another limitation of a financial statement is that it only shares information about one company, and it can be difficult to compare from one company to the next. For example, if you see one company following a particular financial downturn, it can be hard to tell if the trend only applies to that company, if the industry as a whole sees the same pattern, or if the entire market is in a downturn. Statements also provide just a snapshot of a particular point of the company’s finances. They give no context for what might be a seasonal trend. They also rely only on historical information. And, of course, a company’s past profits are not necessarily indicative of future profits.

Finally, financial statements only report on the financial happenings of a company. There may be other qualitative measures of what is happening at a company that you wish to consider when investing.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.