What is a Cash Flow Statement?

A cash flow statement is a document that shows a company’s cash inflows and outflows for a period of time.

🤔 Understanding a cash flow statement

The cash flow statement (CFS) is a way for companies to report on their inflows and outflows for a set period. Any money that a company brings in or spends is included, whether it be related to operating, investing, or financing activities. Money earned, but not yet received, is not included. The inflows and outflows that appear on a cash flow statement include things like income from sales, interest earned, depreciation, payments to suppliers, sales of assets and equipment, payment of dividends, share buybacks, and loans made or received.

A household example of a cash flow statement would be the checking account statement you receive at the end of each month. Assuming you have just one checking account and it serves as your main account, your report will list all of your cash inflows and outflows. It will also include the type of income received and the list of things that you spent money on, just like a business’s cash flow statement.

Takeaway

A cash flow statement is like a security-card system for a big, corporate office building...

Everyone swipes in and everyone swipes out, leaving a record behind — just like a cash flow statement is designed to track every dollar coming in and leaving.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

- What is a cash flow statement?

- What is cash flow?

- What is free cash flow?

- What is included in the different types of cash flow?

- Where can I find an example of a cash flow statement?

- Why do investors care about cash flow statements?

- How to calculate cash flow

- How does a cash flow statement differ from a balance sheet or income statement?

What is a cash flow statement?

A cash flow statement is a financial document that shows the money that flows into and out of a company. The cash flow statement only shows the actual flow of cash. It does not account for money that has been earned but not received or money that is owed but has not been paid.

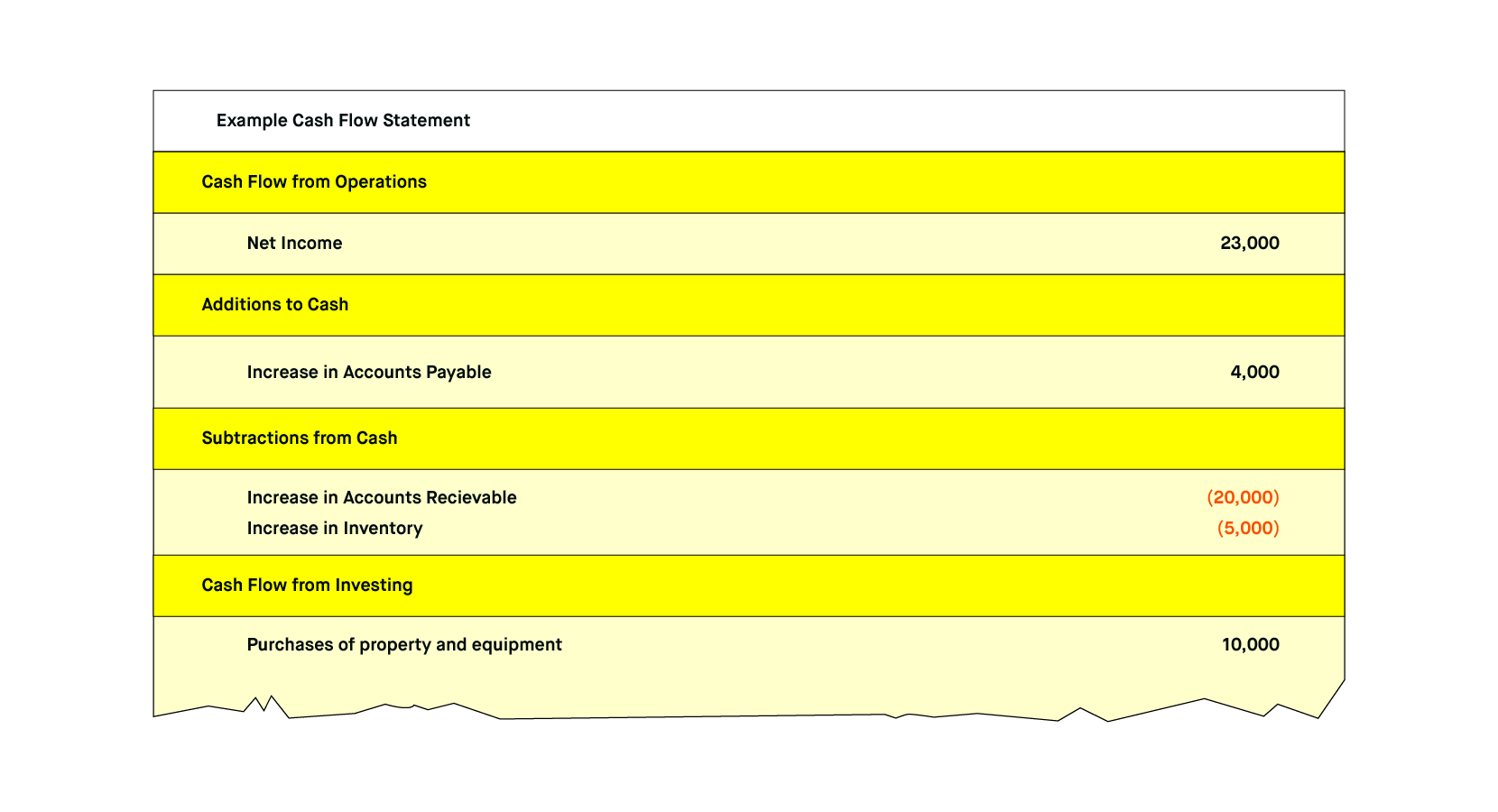

Cash flow statements are divided into three categories of cash flows: operating, investing, and financing. Each cash flow statement will show the types of cash flow within each of these categories and then the total cash flow for each category before putting it all together into one cash flow statement. This division of the different categories of cash flow helps businesses and investors see what parts of the company produce cash flows.

The cash flow statement, alongside the balance sheet and income statement, serves as a way for investors to look at a company’s financial information and how it manages its financial resources. In particular, the cash flow statement shows how a company manages its bank account balances and how it comes up with the money it needs to pay the bills.

What is cash flow?

Put simply, cash flow is a payment from one party to another. Whenever you pay a business for a good or service, cash is flowing from you to that business. Whenever the company pays one of its suppliers, cash flows from the business to the supplier.

Cash flow does not need to involve actual cash. It can include cash equivalents like short-term government bonds, treasury bills, or marketable securities.

Businesses want to produce positive cash flow, which means that more money is flowing into the business than flowing out of the company. If a company produces negative cash flow, that means that more money is flowing out of the company than into it.

Cash flow is essential to businesses because, without it, they are unable to cover their bills and liabilities. Even a successful company will run into issues if it does not manage its cash flow properly. For example, a company cannot pay its suppliers with money that it is owed but has not received.

What is free cash flow?

Free cash flow is a concept related to cash flow. While cash flow tracks all inflows and outflows of cash, free cash flow looks at what is left after a company covers its cash expenditures. That means it includes expenses like payments to suppliers while excluding things like depreciation and other costs that don’t require a cash outlay. Interest payments are usually excluded as well despite their cash costs.

Unlike other measures such as net income, looking at free cash flow lets a company see how much money it produces after accounting for investment in equipment and other capital costs. The free cash flow that’s leftover is the money that is available to return to shareholders.

Because free cash flow accounts for capital expenditures, even healthy companies can have negative free cash flows. Negative free cash flow can indicate significant spending on equipment or other investments to grow the business just as well as it can show a company that is failing to produce the cash inflows it needs.

What is included in the different types of cash flow?

Operating Cash Flows

Operating cash flows are the cash flows produced by the core parts of the business. For a retailer, these cash flows include customer payments for goods and payments to suppliers for products the retailer sells.

Investing Cash Flows

Investing cash flows include the cost of buying equipment, property, or securities, and any gains that the company receives from the sale of these types of assets. Typically, companies invest in equipment and use it, allowing it to depreciate. It’s relatively rare for a company to buy a property and sell it for a profit in the future, so investing cash flows tend to be negative.

Where can I find an example of a cash flow statement?

Companies produce cash flow statements and submit them to shareholders. They typically also post them on their investor relations websites, so you can find the cash flow statement of any public company by searching the company’s website.

Market news and research websites also track company cash flow information and post company cash flow statements on their websites.

Here is Amazon’s cash flow statement for 2024 as an example.

Why do investors care about cash flow statements?

Investors care about cash flow statements because they show whether a company is producing a positive stream of money from its operations. Well-established companies should be able to cover their operating costs from the money they bring in instead of needing to borrow money to cover expenses.

Cash flow statements show both the cash flow that a company produces as well as the source of those cash flows, which gives investors insight into how the business produces its revenues and how the business spends money.

Generally speaking, the more positive cash flow a company produces, the better it is for the company’s investors. More cash flow means more cash left over after the company meets all its spending needs. That means more cash is available to return to investors through dividends or share buybacks.

Where this rule often breaks is in the case of quickly growing companies. Companies need to invest a lot of cash in expansion when they are trying to grow, which can produce negative cash flow even as the plan succeeds and the business expands.

How to calculate cash flow

You can calculate a company’s cash flow using the following formula.

Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

The formula for Operating Cash Flow is:

Operating Cash Flow = Net Income + Depreciation and Amortization costs +/- Changes in Working Capital

Working capital is the difference between a company’s Current Assets (cash on hand, accounts receivable, and other easy to access money) and Current Liabilities (accounts payable, short-term debt)

The formula for Investing Cash Flow is:

Investing Cash Flow = Net Expenditures on Property, Plants, and Equipment, + Gain or Loss from Sale of Long-term Investments

The formula for Financing Cash Flow is:

Financing Cash Flow = Cash received from sales of stocks or bonds - dividends paid - money spent on share buybacks

Any of these formulas can produce a negative result, which indicates a negative cash flow.

If you’re trying to find Free Cash Flow, the formula is:

Free Cash Flow = Cash Flow from Operations - Capital Expenses

How does a cash flow statement differ from a balance sheet or income statement?

Cash flow statements differ from balance sheets and income statements because they track different metrics.

Cash flow statements examine the flow of money into and out of a company. Balance sheets list all of a company’s assets, liabilities, and shareholder’s equity during a set period. While cash is an asset, balance sheets are unconcerned with how that cash entered or exited the business’s accounts. It simply lists the account balance at the time the balance sheet is prepared.

Income statements are more closely related to cash flow statements but are not directly focused on the movement of cash. For an income statement, accounts receivable or accounts payable are significant because income statements track when companies earn income or incur costs, not just when cash changes hands. Cash flow statements don’t look at accounts receivable, taking notice only when money is received or paid. Put another way, income statements work on an accrual basis while cash flow statements work on a cash basis.

Another important difference between cash flow and income statements is how they are divided. Cash flow statements track three types of cash flow: operating, financing, and investing. Income statements only look at operating and non-operating.

The differences between cash flow and income statements mean that they are useful for different things. Income statements can show whether a company is profitable while cash flow statements can show how liquid the company is. Even a profitable company can run into issues if it does not have the liquidity to pay its bills on time. Similarly, unprofitable businesses can continue to operate for a while if they have the cash to pay their bills.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.