What is an Interest Rate?

An interest rate is what the lender charges for the use of its assets, such as cash, a vehicle, or property, shown as a percentage of the principal, the amount borrowed.

🤔 Understanding interest rate

An interest rate is the lender's fee for the use of assets shown as a percentage of the principal, aka the amount of the loan. Typically, the interest rate is noted on an annual basis, which is why it’s known as the annual percentage rate (APR). Examples of assets borrowed could include cash, consumer goods, or items such as a vehicle or building. In the case of loans, the interest rate applies to the principal. An interest rate is the price of debt for the borrower and the part of the expected return for the lender. Interest rates affect the total amount you pay for homes, cars, and other purchases made with credit.

Imagine that you currently have $1,000 in a savings account that has a 1.0% annual interest rate. The bank will pay you 1.0% annually for you to entrust your money to them. However, you want to earn more from your savings. Thus, you decide to transfer your funds to a competitor bank and into a 2-year certificate of deposit (a certificate issued by a bank to depositor for a specified period of time) account, which has a 2.5% annual interest rate. After two years, your balance with the competitor bank is $1,051.22, whereas it would have been only $1,020.19 if you had left your funds at your original bank.

Takeaway

Interest is like a rolling snowball accumulating mass...

While your snowball (the principal) starts small, it continues to grow over time as snow (interest) collects. The higher the interest rate, the faster the snowball grows. When you borrow money, you start pushing the snowball uphill, and the longer you do it, the more difficult it can become to pay back what’s owed. But, if you are lending money, you are rolling the snowball downhill and the longer money is owed to you, the more interest you’ll gain.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

- What is interest?

- How do interest rates work?

- How does interest work in a saving’s account?

- What is the role of the Federal Reserve in regards to interest rates?

- What is simple versus compound interest?

- What is APR versus APY?

- How to calculate different kinds of interest?

- What are credit card APR Types?

- What are car loans and payday loans?

- How does mortgage interest work?

- Past examples of factors affecting mortgage interest rates

- What are some interest rate spreadsheets and calculators?

What is interest?

The cost of borrowing money is known as interest. Interest is like paying rent for using someone else's money — The more time you pay interest, the more cumulative interest you pay back. Lenders make a profit using the interest paid in addition to the original loan amount. A portion of a loan (or deposit) balance is used for the interest calculation that is payable to the lender. The amount shown is an annual rate, but interest can be calculated for different periods of time, too.

How do interest rates work?

Interest affects the total amount you pay to completely pay off a loan. For example, if you borrow $1,000 with a 10% annual interest rate, you will pay $1,100 back to the lender, and the lender of which, $1000 is principle and $100 is interest.

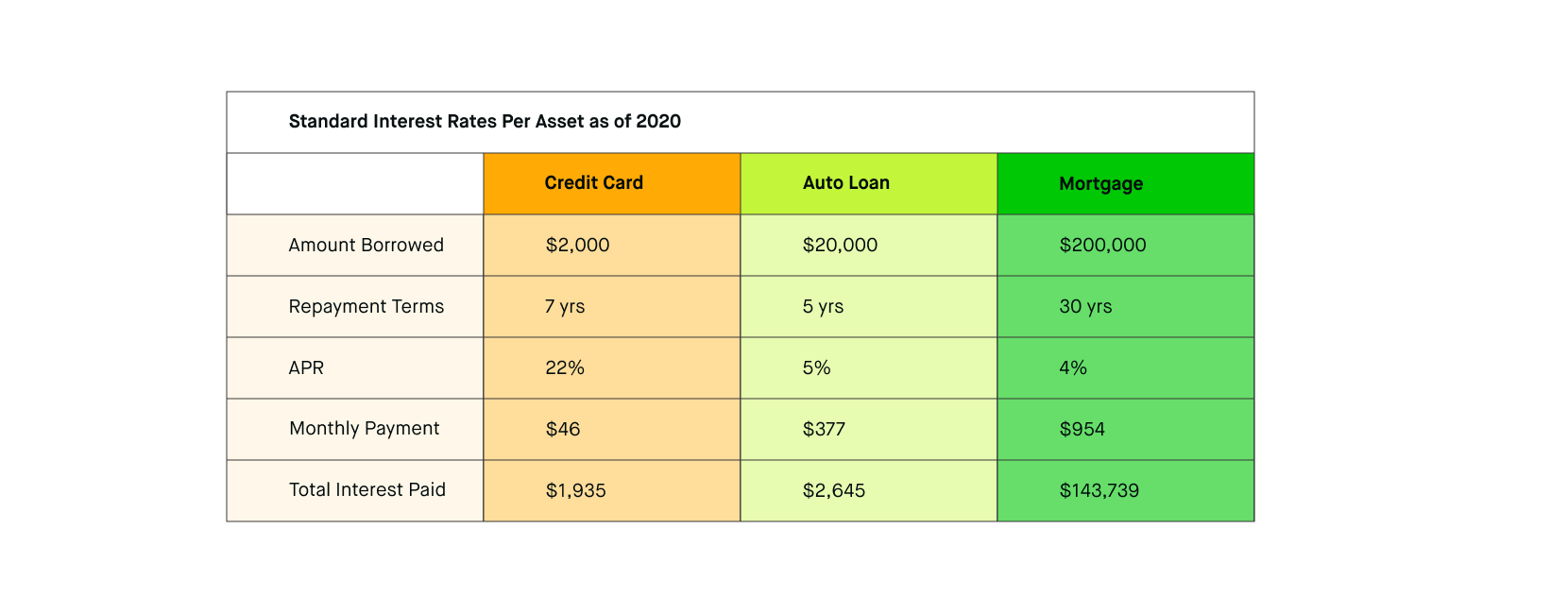

Interest rates are a recurring theme in our financial lives, but sometimes it's tricky to sort them all out. For example, you might pay 5.0% interest on your auto loan, 4.0% on a home loan, and 14% on your credit cards, but earn less than 1.0% in your savings.

Every loan agreement should contain a stated rate of interest. The rate calculation is derived from many factors, including:

- The principal amount (the initial amount borrowed)

- The length of the loan term

- The repayment schedule (how often you must make payments)

- Payment amount (how much each repayment is)

- Market factors (such as prevailing interest rates)

- The borrower’s credit-worthiness (how likely lenders believe you are to repay in full)

The table below describes how interest rates work when borrowing, lending, and earning:

__Table 1: Different Types Of Interest __

How does interest work in a saving’s account?

A savings account can be viewed as the opposite of a loan because instead of borrowing money, you are providing the bank with money that can be loaned out to others. As a reward for keeping your money with a bank, you will receive interest on your savings.

Since the bank will be paying you rather than collecting money from you, the rates will generally be much lower than the rate at which you borrow money. Typically online interest rates for savings are around the 1 to 2% range.

There are also strict requirements accompanying savings accounts. For example, you might have limitations on how to use the savings account, such as minimum balance requirements and minimal transactions. Accounts with fewer restrictions may pay you lower interest rates too.

Due to the current low-interest rate environment, savings accounts may be more suitable for emergency funds but generally, are not high-return investment vehicles. Some savings account alternatives that may have higher yields are:

- Certificate of Deposits (CDs)

- Money market funds

Be aware that CDs, checking and savings accounts through banks are FDIC-insured, and money market funds are not.

What is the role of the Federal Reserve in regards to interest rates?

The central bank of the United States is the Federal Reserve Bank. The central bank dictates the federal funds rate, which is the rate at which one bank will charge another bank for overnight (very short term) loans. These loans are used by banks to either borrow or lend out to other banks to help them meet legal reserve mandates.

The Federal Reserve also sets the “federal discount rate.” When national banks borrow from the Federal Reserve, they are charged this rate. The Fed impacts the rates at which banks charge for loan products when the federal discount rate is modified.

Typically, the Federal Reserve will raise interest rates in good economic times (bull markets) and lower them when the nation is facing economic downturns (bear markets). Lower interest rates encourage consumers to spend rather than save, thereby helping to re-energizing a declining economy. The interest rate is also used to help control inflation. A lower federal funds rate means more money in circulation, which can lead to higher inflation. Conversely, a higher federal funds rate means less money in circulation, which tends to lower inflation.

Lending institutions will generally raise and lower their interest rates based on changes by the Federal Reserve. Here are examples of different loans that will be affected:

- Certificates of Deposits (CDs)

- Auto loans

- Savings accounts

- Credit cards

Although a federal rate increase may have a minor impact on mortgage rates, analysts usually consider different factors. Variable mortgages are more susceptible to changes made by the Federal Reserve since they use the prime rate, the federal funds rate, in their calculation.

What is simple versus compound interest?

Interest for loans come in 2 main types: simple and compound interest.

The formula for simple interest is: Simple Interest = (Principal Amount) x (Rate of Interest) x (Time)

For example, to calculate earnings for a savings account with $2,000 and 4% interest, using simple interest, you multiply $2,000 in savings by 4% interest.

$2,000 x .04 = $80 in profit

So your account balance after one year = $2,080. In other words, with simple interest, you’d earn $80 over one year.

Most banks calculate your interest earnings daily, not just after one year. Daily calculation benefits you because you take advantage of compounding. Compound interest is more complicated because it is earning interest on top of the interest that you received previously.

For example, say you deposited $1,000 in a savings account that pays a 5% interest rate, using compound interest.

The formula for compound interest is: Compound interest = (Principal Amount) x ((1 + Interest Rate)n – 1)

Whereby: n = the number of compounding periods.

So using the same scenario as above but assuming daily compounding, you would end up with a balance of $1,051.16 at the end of one year.

Your annual percentage yield (APY) (the official rate used for borrowing including associated fees) would effectively be 5.12% and you would earn $51.16 in interest over the year.

This extra $1.16 in earnings might seem small, but with more extended periods and/or additional deposits, the profits can become more ‘interesting’.

What is APR versus APY?

The Annual Percentage Rate (APR) is the official rate used for borrowing. In its calculation, both the cost of borrowing and any associated fees are included. The APR is meant to give you the overall equivalent cost of a loan.

For example, it can be possible that the interest rate is 14% annually, but the APR is 17% because of the inclusion of charges that add the cost equivalent of another 3% in interest.

APR is similar to the Annual Percentage Yield (APY), but APY also considers compounding. APY is great since it considers compounding that a simple "interest rate" doesn’t.

Remember, compounding occurs when you earn interest on top of the interest that you already received. This means you're making more than the quoted interest rate. However, when you borrow money, you typically only see the APR. Though actually, you may pay APY, which is usually greater with specific kinds of loans.

How to calculate different kinds of interest?

Table 2 below describes different types of interest:

__Table 2: Interest Types __

| Interest Type | Description |

| Installment Debt | Installment Debt is typical with loans such as a standard home, auto, and student loans. The interest costs are included in your monthly payment. Each month, a part of your payment reduces your debt. Another part is your interest cost. You pay back your debt over a specific period in these types of loans -- for example, a 30-year mortgage or a 5-year auto loan. |

| Revolving Debt | Another type of debt is revolving loans. This means that you can borrow more monthly and make installment payments on the debt. Credit cards are a good example; they allow you to spend repeatedly as long as you stay below your credit limit. Interest calculations can differ, but it’s not too hard to figure out how interest is charged and how your payments work. |

| Credit Card Interest – Fixed APR | A fixed APR typically remains the same throughout the life of the loan but can change for credit cards. Usually, you should receive a notice of any change so you can make a decision. However, it can change in certain other circumstances. For example, if your payment is more than two months late or when a special introductory offer terminates. |

| Credit Card Interest – Variable APR | A variable APR usually follows the prime rate, which is controlled by your nation’s central bank. Most of these rates begin with the prime rate plus a margin resulting in your variable APR. |

What are credit card APR Types?

Many factors can affect the APR of your credit card at the table below summarizes:

__Table 3: Common Factors Affecting Credit Card APR __

| Factor | Description |

| Purchase APR | This is the interest rate applied to recent credit card purchases. By the end of your billing cycle, if you haven’t paid off your recent purchases yet, then this purchase interest is applied. |

| Balance transfer APR | This APR occurs when you transfer debt from another card. Typically, this is done to acquire a 0% promotional APR that lets you pay off the balance without incurring more interest. |

| Cash advance APR | This APR is the interest rate used for the cash borrowed from your credit card, which tends to be greater and usually does not have a grace period. |

| Promotional APR | This APR is usually a short-term promotional rate offered by credit cards to incentivize you to sign up. This APR can apply to both purchases and balance transfers for a set period. This rate is usually lower than the regular APR and sometimes can even be zero. |

| Penalty APR | For late payments or other violations, this is the interest charged. As a punishment, this rate is typically the highest APR. It may also impose when your payment is more than two months late. |

What are car loans and payday loans?

The car is used as collateral when you apply for a car loan. Most lenders will require you to have auto insurance to protect their interest in the vehicle if you get into an accident). When you default on too many payments, the lender can repossess the vehicle to try to cover the costs of the given loan.

Borrowers can expect lower interest rates on auto loans because repossessing a vehicle is reasonably easy and doesn't cost the lender much in fees. (Note: If the lender can’t recover enough value from the physical vehicle, the borrower is liable for any balance due). Car loans typically have interest rates in the 4 to 5% range.

A short-term payday loan is a small loan used if cash is required as soon as possible. To encourage fast repayments and recover high loss rates, lenders will often use extremely high-interest rates as usage fees.

How does mortgage interest work?

A home loan, a mortgage is the largest debt most people will ever possess. Thus, it’s essential to understand all the factors when home buying. The mortgage rate for a certain loaned amount can vary depending on the buyer’s creditworthiness and economic trends in the nation amongst many other factors.

Considerations also include how much of a down payment that the buyer can make.

Simple interest is used by most mortgages. Though, some loans do use compound interest that factors both the principal and the accumulated interest from previous periods.

Carefully look at each lender’s quote to find the best loan for you. These are some of the factors to analyze:

- Brokerage fees (if applicable)

- Interest rates

- Administration fees

- Closing costs

- Pre-payment penalties

Past examples of factors affecting mortgage interest rates

The federal funds rate affects home equity lines, credit card rates, and even mortgage rates, although indirectly.

On September 18, 2019, the Federal Reserve cut rates for the second time since December 2008. Weak economic data has combined with pressure from President Trump to lower rates.

Currently, the Federal Reserve is expected to do something thought unlikely earlier this year — cut rates for a second time. This strategy can have a serious effect on mortgage shoppers. Home financing seekers have an opportunity with rates for 30-year fixed rates around 4% and the possibility of even lower rates for other types of mortgage loans.

Many are asking if mortgage rates will drop further. Many analysts think so, due to several factors that are pushing for a new low rate environment. First, there is a trade war with China. Trade wars frequently lead to sluggish economies on both sides. As experts of mortgage rates know, sluggish economic activity usually means lower rates. Second, as the Federal Reserve lowers the federal funds rate, this will also indirectly lower mortgage rates too.

President Donald J. Trump is also in favor of lowering interest rates as he recently said:

“The Fed should get our interest rates down to zero, or less, and we should then start to refinance our debt. Interest cost could be brought way down, while at the same time substantially lengthening the term. We have a great currency, power, and balance sheet..”

Source: Twitter: Donald J. Trump (@realDonaldTrump) September 11, 2019

Disclosure: These predictions may not be right. Example of past factors that influenced mortgage interest rates may not necessarily affect future rates. Please do your research about expected mortgage interest rates and consult your lender.

What are some interest rate spreadsheets and calculators?

Here is a calculator for determining how money can grow with the power of compound interest, provided by the US Securities and Exchange Commission (SEC): https://www.investor.gov/additional-resources/free-financial-planning-tools/compound-interest-calculator

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.