What is a bid/ask spread?

- Getting a fill on your options order is often a tradeoff between price and speed

- Your order is more likely to get filled when it’s at the natural price — the ask price (for buyers) or the bid price (for sellers)

- The mark price – halfway between the bid and the ask – might offer you a better price, but your order may not be filled as quickly

If you’ve ever shopped at an online auction, you’ve probably noticed that there are two ways to make a purchase – you can either buy something immediately for whatever price the seller is asking, or you can place a bid, where you set your own price. Ultimately, it’s a tradeoff between getting the best possible price versus buying immediately.

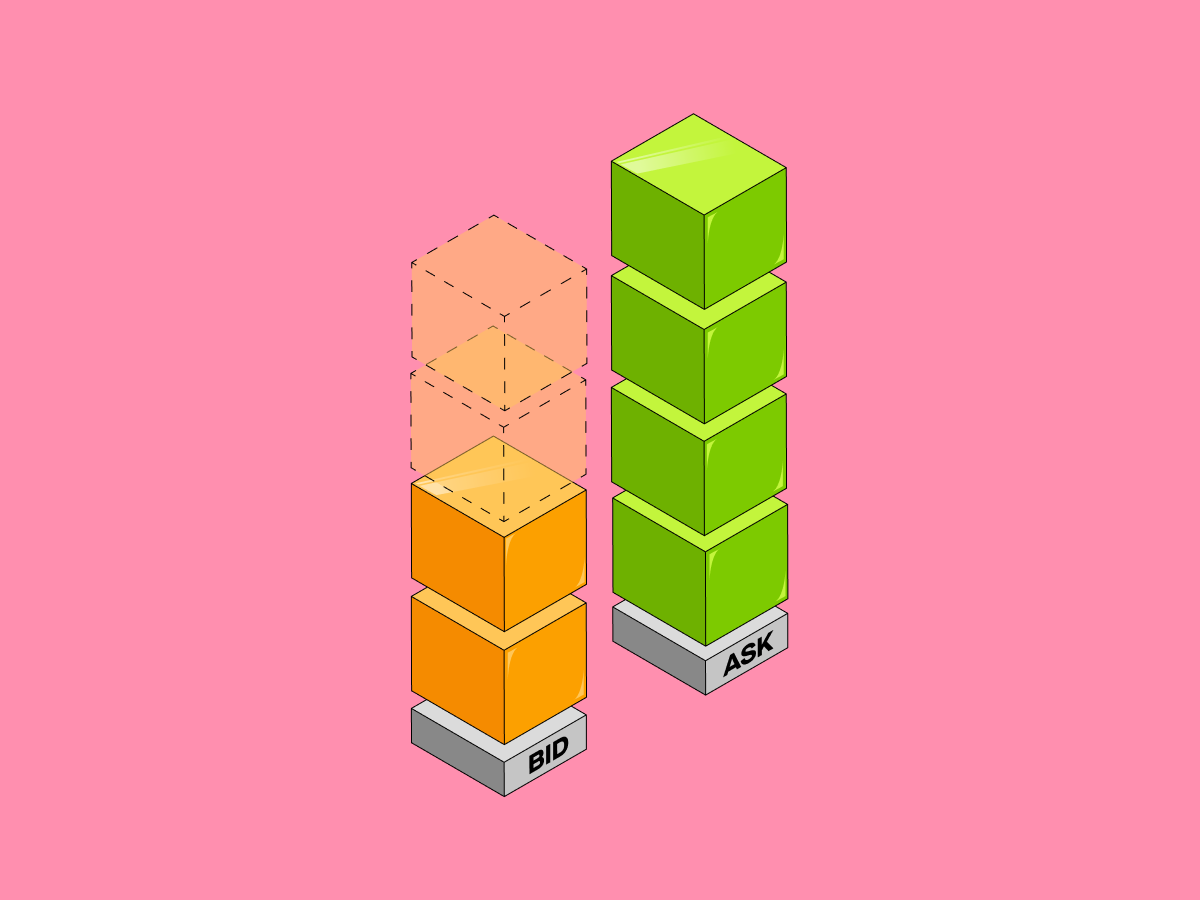

Financial markets aren’t that different. For every stock or options contract, there is an ask price, which is the lowest price a seller is asking for. There’s also a bid price, or the highest price a buyer is currently willing to pay.

You’ll notice that the bid price is almost always lower than the ask price. This difference between the bid and ask price is called the bid/ask spread. The bid/ask spread is an indication of supply and demand: A narrow bid/ask spread typically indicates a high demand, whereas a wide bid/ask spread generally means that fewer people are trading that product.

Who determines the bid and ask prices?

Prices are driven by all market participants. Imagine all of the people who might be making trades: investors from big institutions (think: hedge funds, banks, pension funds, mutual fund managers, etc.), financial advisors, and individual retail investors (think: people like you).

Given all of the people and institutions wanting to trade different sized lots, there needs to be a way to facilitate these trades. A market maker’s primary job is to match potential buyers with sellers.

Market makers play an important role in helping to provide liquidity to financial markets, meaning that you’re generally able to buy and sell easily and quickly. Without market makers to facilitate trades, it would be much harder to buy and sell when you want, and at the price you want.

Sometimes, there isn’t always a perfect match at exactly the right time. Market makers are there to buy when no one else is willing to buy, and sell when no one else is willing to sell. For this, market makers are compensated – similar to the way a physical or virtual auction might get a small fee for providing a place to facilitate sales. The market makers’ cut is the difference between the bid and the ask.

Liquidity

The bid/ask spread can vary greatly depending on the supply and demand for a particular product. A narrow bid/ask spread typically indicates good liquidity. Pay attention to the liquidity, because illiquid options with a wide bid/ask spread can cut into your potential profits, among other issues.

Imagine an options contract with a $.75 bid and a $1.00 ask. If you were to buy that contract for $1.00 and then immediately sell that contract back, you’d incur a 25% loss without the option’s price even changing.

Working your options orders

When buying and selling options contracts, your order is more likely to get filled when it’s at the ask price (if you’re buying) or the bid price (if you’re selling). This is also called natural pricing.

- For buyers, the natural price is the ask price

- For sellers, the natural price is the bid price

If you’re looking for a better price, you could potentially work your order, meaning offer a lower price (if you’re buying) or a higher price (if you’re selling). Some traders might attempt to get their order filled at the mid price, also known as the mark. This is halfway between the bid and the ask. For example, the mark price for an options contract with a $2.00 bid and a $2.10 ask would be $2.05.

The benefit of the mark price is that you’ll pay less (if you’re a buyer) or get more (if you’re a seller). However, your order has less of a chance of getting filled. Similar to a virtual auction, if you’re trying to buy, a higher bid increases your chances of winning an auction. A lower asking price increases your chances of selling.

Choosing your price

At Robinhood, the default for options orders is now the natural pricing. This means that your order will pre-populate with the bid price (when selling) or ask price (when buying). If you send your order at the natural price, it is more likely to be filled, assuming there’s enough liquidity for that particular contract.

However, you have the choice of setting your default pricing to either the natural price or the mark price. The benefit of using the mark price is that you can work your order, and may get a better price for your contract. The tradeoff is that you may have to wait longer for your order to get filled, or possibly, your order might never be filled. Remember, you can always update your order price by canceling and replacing.

To change your default settings, the gear icon above the option chain. Here, you can choose between defaulting to the natural price or the mark price.

Note: At Robinhood, regardless of your default setting, mark price will still be used for a) multi-leg orders, b) options rolling, and c) calculating “Current Price,” “Total Return,” and other information regarding contracts you currently hold (e.g. your portfolio return).

Order types

When placing your order at Robinhood, you can use either a limit order or a stop-limit order:

- A limit order allows you to set the maximum price (or lower) at which you’re willing to buy or the minimum price (or higher) at which you’re willing to sell.

- A stop limit order activates a limit order once a certain price is reached, known as the stop price.

Keep in mind, limit orders aren't guaranteed to execute. There has to be a buyer and seller on both sides of the trade. If there aren't enough contracts in the market at your limit price, it may take multiple trades to fill the entire order, or the order may not be filled at all.

Marketability

When reviewing your limit order while trading options at Robinhood, you’ll be able to see the likelihood that your order will be filled within three seconds after submitting your order. This likelihood is calculated based on historical options data using information like: bid, ask, size, last sale price, date, time, and distance from the spread.

You’ll either see a low, medium, or high fill likelihood:

You can potentially use this information to adjust your price: If you see a low fill likelihood, you can increase the probability that your order will get filled by moving the price closer to the natural price.

Note: Content here should be used for informational purposes only and should not be considered a recommendation or investment advice.

Disclosures

Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount.

Robinhood Financial does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Supporting documentation for any claims, if applicable, will be furnished upon request.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.