We’re in a bear market — So, what does that mean?

- A bear market is a period following a 20% drop in stocks from a recent high

- On average, an event-driven bear market lasts about nine months [1]

- The US stock market has eventually recovered from every previous bear market [1]

How do we know we’re in a bear market? It’s not a hard and fast rule, but investors and market watchers tend to call conditions a “bear market” when stocks have dropped 20% or more from a recent peak. At this point, market declines have exceeded this by quite a bit. Between its Feb. 19 peak and March 17, the S&P 500, an index of 500 large US companies, fell nearly 30%, a sure-fire sign that Wall Street is under duress. The Dow Jones Industrial Average, an index that tracks 30 of the largest and most respected US companies, fell about 31% over the same period. For some context, the last time US stocks were in this position was during the 2008 financial crisis, and President Trump said on March 16 that we might be heading for a recession.

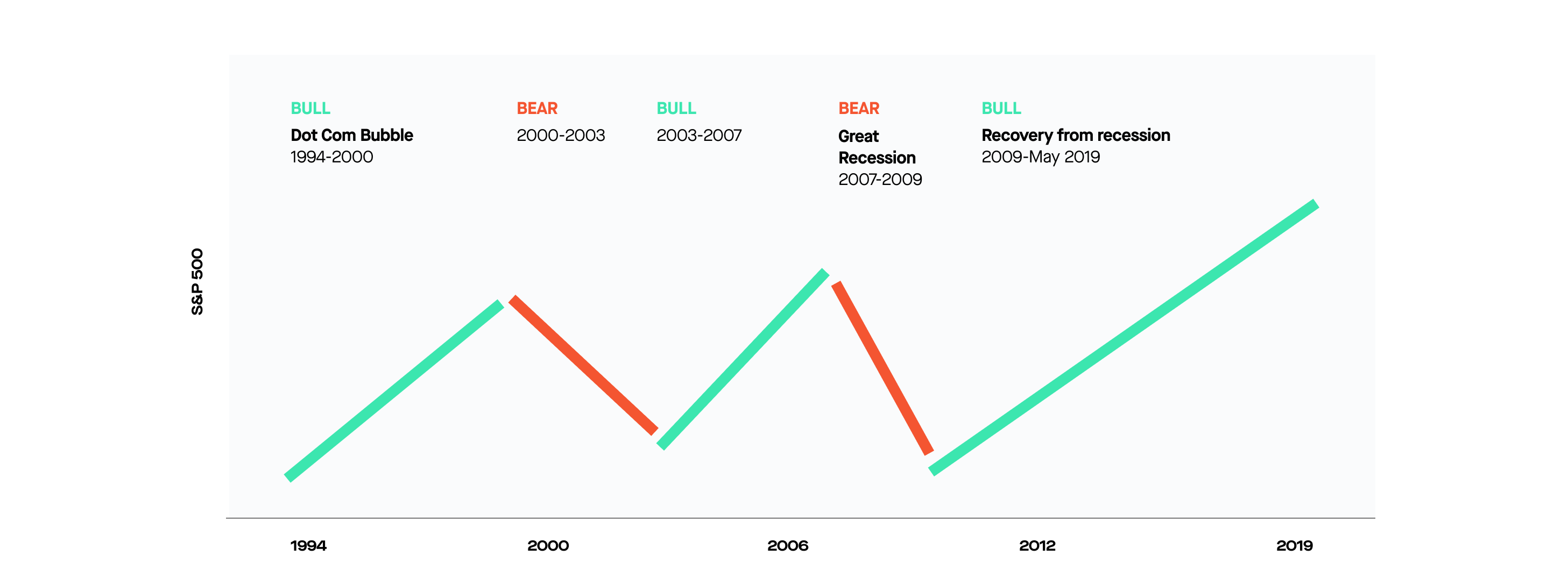

How serious is this? First, it’s vital not to panic or let emotion override your investing plan—although that’s easier said than done. Stocks have a history of sliding into bear markets, or worse, and recovering. There have been about a dozen such bear markets since World War II, not counting our current one. (One of those declines, in 1990, was 19.9% making it a borderline bear market.) It’s important to know, there’s no set duration for a bear market, and recovery can be a bumpy, unpredictable prospect.

Here’s some more info on bear markets to provide context and shed some light on how to react:

How long have bear markets lasted in the past?

As we mentioned, bear markets don’t have a set length. They can last just a few weeks, or drag on for several years. So, nobody knows if we’re in for a light snooze or a full-blown hibernation. Going back to the 1800s, on average, event-driven bear markets have lasted about nine months each, with varying causes.

During these downturns, stocks have shed roughly 30% each time.* That means, the present bear market (if it ends today) would be in line with financial history. Of course, a notable difference about the current situation is the speed of the market’s decline. This time around, it took just three weeks for stocks to plummet —and the uncertainty over treatment options for coronavirus makes the timeline for a recovery difficult to forecast.

Investing in a bear market is kind of like bungee jumping…

When a person decides to go bungee jumping, they usually have to sign a waiver acknowledging the dangers and releasing the operator from liability. After all, it’s pretty gutsy to willingly jump off a bridge (even with a helmet). As a bungee jumper, you’re pretty sure you’ll come out alive. But you know there’s a chance things could go wrong (e.g.., the cord could snap or your harness could fail catastrophically). Buying into a bear market is similar. History indicates that the stock market bounces back from its declines. However, you must be aware, the bottom could fall out of the stock market, leaving the economy and your investments in freefall. As such, people who participate in this investment strategy take a calculated risk that they or their portfolio will not bounce back.

What triggered our current bear market?

Fears about the global spread of the novel coronavirus (COVID-19), and its toll on economies around the world, have been cited as key triggers of the current market conditions. (It’s important to note though, that while COVID-19 has sometimes been cited as the trigger, the economy may have been predisposed to a correction due to many factors including a 10-year-plus bull market that may have run its course.) Factory activity in China, and manufacturing activity in New York state (an indicator for overall economic activity in the US) have both taken a hit, underscoring concerns among investors about how the virus could hamper global economic output. With millions of people across the world practicing “social distancing,” it’s hard to gauge when life may return to normal. The potential knock-on effects from the closure of small and medium-sized businesses could hurt Wall Street and other facets of the world economy.

There are other concerns, too: How will coronavirus impact restaurants and airlines? By extension, what will happen to suppliers? (Not to mention, potentially millions of people who could lose their jobs globally in an extended rout.) The coronavirus has already interrupted a wide cross-section of industry, with many businesses shutting to the public. Some sports leagues like the NCAA (National Collegiate Athletic Association) have even postponed—or in some cases, cancelled—their seasons. Of course, the dramatic global response could temper fears and possibly mitigate the financial fallout. Researchers are also working round the clock to develop a COVID-19 vaccine. So, if the efforts are successful, the hope is the recovery will be as swift as the drop. But the sobering history is that market recoveries have mostly been slower than their declines. [1]

How is a bear market different from a correction?

A bear market is more severe. While a “correction” typically identifies a 10% drop in stocks, a bear market corresponds to a 20% decline from a recent peak. The last time a correction happened was in late 2018.

Why is it called a bear market? And what about a bull market? - One Explanation

Bear markets are named for the attacking style of bears. With their paws, they typically swipe down on their prey.

Bull markets are named for the attacking style of bulls. When they charge, bulls often thrust upward with their horns. Just watch a bucking bull in competition (or the intrepid cowboys they try to launch in the air). A bronze statue of a charging bull stands in the financial district in New York City represents its significance. It’s sometimes called the Wall Street Bull.

What should you expect during a bear market?

For many investors, this might be the first time you’ve experienced a bear market. What you should know is this: The US stock market has recovered from every previous bear market. So, as bleak as the stock market looks today, you’ve got to keep your wits about you and think of the bigger picture. Of course, stocks could trend in either direction. But historically speaking, the odds are in favor of recovery, at least eventually.

Over the course of your investment life, you’re almost certain to experience highs and lows. The question is, how will you respond to market volatility? Can you keep a cool head about you?

Approaching your investments in a bear market

At a time like this, it’s crucial to assess whether your investing style has provided the financial balance you desire. Do you have enough cash on hand to weather the storm in the event of job loss or a health scare? If you have an emergency fund, can you afford to cover a few months rent or stock up on supplies? Will your loved ones need help? If you’re able, you may want to revisit your retirement contributions. Depending on your situation, this could be a time to change your contribution rate or how your contributions are allocated. Some investors might look at this as an opportunity to take advantage of reduced stock prices, bumping up exposure. Others may see it differently and reduce their exposure given the uncertainty. It could be that some people need more cash in their pockets today so they make different decisions.

Even if you’ve only been investing for a short time, you might be able to learn from your own recent behavior. What did you do during the stock market correction in late 2018? Did you ride it out? Maybe increased your exposure to the market, or perhaps you pulled back from the market altogether. If you stuck with it, you may have benefited from the stock market’s subsequent rally during 2019. But like today, in the moment, nobody knows where the market will go and it could have kept declining. For investors who are concerned that the stock market will continue to sink, there are many ways to proceed including purchasing securities that move the opposite the market, or reallocating from high to low risk holdings. One more advanced approach is the use of options, but given their additional risks and complexity they are not for everybody.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.

Should you buy or sell in a bear market?

Generally speaking, at first you probably want to avoid taking any immediate action (e.g., selling at a loss, or hunting for apparent bargains). Once you’ve had the chance to understand the situation and analyze where you are in your plan, then you can evaluate your alternatives

Can you make or lose money investing in a bear market?

Either is possible. When investors dabble in bear markets, they’re sometimes able to find bargain-priced stocks, which offer attractive returns. But in these chaotic times, it can be very difficult and time-consuming to assess businesses or make meaningful projections. It’s possible for investors to get burned badly, throwing hard-earned money at precariously positioned companies. Unfortunately, in the stock market, there are no guarantees.

Does a bear market mean a recession is coming?

Not necessarily. Sometimes a bear market is followed by a recession. Other times, though, a bear market passes without inflicting any additional pain. A recession is marked by two consecutive quarters of decline in gross domestic product (GDP).

While economists and the US president have warned that a recession is possible, that’s not a guarantee. Many market watchers have been predicting a recession for the better part of five years. But if you’d taken their advice sooner, you might have missed out on the stock market’s healthy returns during that time. Of course, staying in is no guarantee either. You could've just as easily lost money during that period.

Even in the event of a recession, it’s possible that certain sectors of the economy will outperform (aka perform better than the market). For instance, consumer staples like food and household goods might remain in high demand. One approach is to focus your investments, or a portion of them, on the parts of the economy you consider more robust. But trying to navigate this strategy is not easy—it takes time and experience, which may not be viable for a vast portion of the investing public. To complicate this every market downturn is different and what worked last time may not work again.

What causes a bear market?

Investors may become bearish or bullish for a number of reasons. And sometimes, they’ll read the same circumstances differently. While one investor might be soothed by the Fed cutting interest rates, another might worry even more. What’s tricky is that primary factors (i.e., COVID-19) and secondary factors (e.g., the reactions of financial institutions and the government) can get rolled into one. It’s difficult to separate these ingredients. While a pandemic may prompt a bear market, past causes include terrorist attacks, shifts in investor sentiment (e.g., the dot com bubble), and changes in international trade and production agreements (as in the oil industry).

What have been the worst market crashes in history?

Two of the worst market crashes happened in 1929, leading to the Great Depression, and in 2008, when many large Wall Street firms collapsed. In 1929, the S&P 500 fell nearly 90%. The 2008 financial crisis was also gruesome. From October 2007 to March 2009, the index plummeted about 56%.

For investors, a bear market is a time to test your mettle. Although there’s plenty of uncertainty—about the coronavirus and the stock market—you can control your own response. You may assess the playing field and search for investment opportunities, stay put, or change your approach during these challenging times.

To learn more about the risks associated with options trading, please review the options disclosure document entitled Characteristics and Risks of Standardized Options, available here or through https://www.theocc.com. Investors should absolutely consider their investment objectives and risks carefully before trading options.

The S&P 500 is an index of 500 large capitalization stocks. The Dow Jones is an index of 30 large and respected stocks. Both are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). Indexes cannot be invested in directly, do not charge expenses, and are unmanaged.

References

- Goldman Sachs Portfolio Strategy Research. “Bear Essentials: a guide to navigating a bear market.” (March 2020). Date accessed: March 17, 2020.

https://www.goldmansachs.com/insights/pages/briefly/bear-essentials.pdf

- Percentage drop and duration of declines vary each time. Refer to historical charts (Yahoo Finance) to view further data.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.