What are Capital Gains?

A capital gain is the amount an asset increases in price from when you buy it to when you sell it.

🤔 Understanding capital gains

Capital gains are realized when an investor sells an asset, such as a stock, at a price higher than the price paid to purchase it. When an asset is not sold, but simply held at a price higher than what it was paid for, an investor is said to have an unrealized capital, or paper, gain. Capital losses, on the other hand, occur when an asset is sold for less than what was paid for it.

If you bought stock in MEOW Corporation (a fictitious company) at the beginning of 2020 at $100 a share. Say, you sold the stock the end of 2022 for $125 per share. Therefore,

Selling price (per share) - Purchase price (per share) = Capital gain (per share) $150 - $125 = $25 per share

Further,

Capital gain (per share) x Number of shares = Total capital gain

Using the example above, here is what your capital gain would have been if you had bought and sold ten shares:

$25 x 10 = $250

Takeaway

Remember trading baseball cards as a child...

Capital gain is the profit you earn on the sale of that one card in the deck you knew you were going to trade because it could sell for more money than you paid for it.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

What is capital gain?

Capital gain is equal to the profit earned on the sale of an asset less any expenses. This amount is subject to taxation by the Internal Revenue Service (IRS) (and potentially by a local tax authority, such as your state).

What is capital gains tax?

Capital gains tax is money owed to the IRS when an investor profits from an investment. Some states may also impose an additional tax on capital gains.

The laws around taxation of capital gains are complex. Tax owed on capital gains depends on the duration an asset is held, the profit realized on its sale, and any offsetting expenses. It also depends on the investor’s income level and filing status. Certain kinds of assets, such as collectibles are subject to different rules (covered below).

Some tangible assets, like your house, can for practical purposes be partially or even entirely exempt from capital gains tax. In the case of a house, as long as an investor has lived in it for two of the last five years preceding the sale, he/she may be exempt from up to $250,000 in gains (or $500,000 if filing jointly with a spouse.)

In general, capital gains on assets held for one year or less are taxed as ordinary income. Assets held for more than a year are taxed at capital gains rates. Further, there are three types of assets that have their own rules:

- Qualified small business stock: Gains on certain types of small business stock are taxed as ordinary income to a maximum of 28% as specified in Section 1202 of the tax code.

- Collectibles: Collectible assets, such as coins, art, precious metals, are taxed as ordinary income up to a maximum of 28%.

- Section 1250 real estate: Certain real estate that has depreciated in the years before being sold and conforms to the standards laid out in section 1250 is taxed at a maximum rate of 25%. IRS Pub 544 is where you can learn more about this situation.

For a more comprehensive picture of the rules on capital gains taxes, refer to the IRS Publication 550.

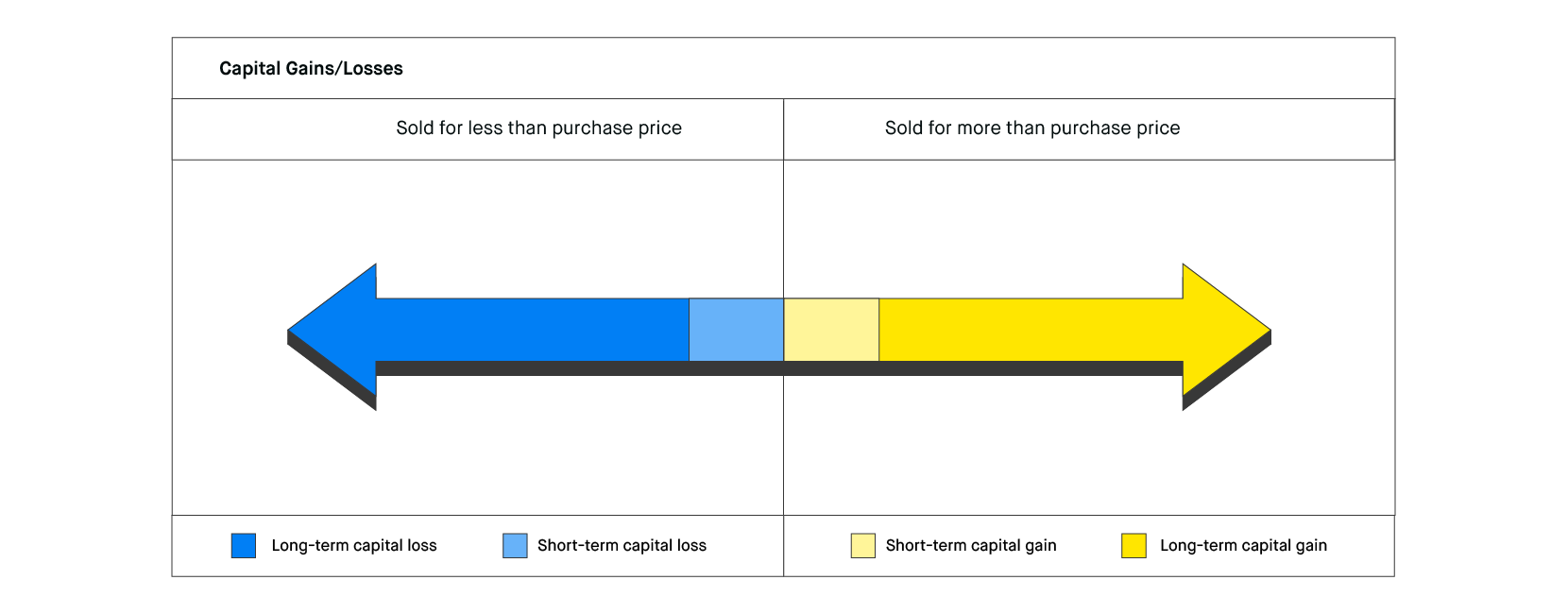

What is the difference between short-term and long-term capital gains?

The difference between short-term and long-term capital gains lies in how long an asset is held before being sold. If sold for a profit, an asset held for one year or less makes for a short-term capital gain. Profit realized on the sale of an asset held for more than a year counts as long-term capital gain.

The two differ because the IRS taxes them differently. Short-term capital gains get taxed as ordinary income, whereas long-term capital gains count as investment income and have their own capital gains tax rate.

These long-term rates are a lot like the regular income tax brackets, but the thresholds and rates are different. One of the most significant differences is that the top tax rate on capital gains is just 20% in 2022, compared to a top rate of 37% for income, though high-earning households may pay an additional 3.8% surtax.

Long-term and short-term gains and losses can be used to offset each other in any given year. For instance, if you had a long-term capital gain of $1,000 this year and a short-term loss of $200, you have a net long-term gain of $800 which will be taxed at the appropriate capital gains tax rate. However, please note additional rules for wash sales if you sell or trade securities at a loss and within 30 days before or after the sale you either buy substantially identical securities, acquire substantially identical securities in a fully taxable trade, or acquire a contract or option to buy substantially identical securities.

How do I calculate my capital gains tax?

Capital gains tax can be calculated based on two things:

- The amount of profit made from the sale of assets in a given tax period

- The capital gains tax bracket an investor falls into based on income and filing status

For starters, an investor must maintain an accounting of every asset sold and determine whether the sale results in a capital gain or loss. To calculate gain or loss, subtract selling price from purchase price. When dealing with several shares of stock, prices can be multiplied by the number of shares being sold:

Total Capital gain or loss = (Purchase price x # of shares) - (Selling price x # of shares) - Any expenses (commissions, margin interest, etc.)

For tax purposes, this calculation needs to be made for each asset sold, whether it is stocks, real estate, or a collectible, such as a piece of art.

Once gains or losses have been calculated, they can be sorted into short-term and long-term buckets. (Note that modern tax preparation will do this for you, but let’s get into the weeds here to continue understanding how capital gains are realized.)

It’s indeed possible that in the sale of multiple assets, an investor incurs both gains and losses. In such a situation, net gains and losses can be calculated. For example, if an investor made a long-term gain of $400 as well as a long term loss of $500, the net long-term loss will amount to $100.

Next, an investor needs to reconcile long-term vs. short-term gains and losses. A net $100 long-term loss and an $800 short-term gain is a $700 net short-term gain.

If the net result is a short-term gain or loss, it will be taxed at a marginal tax rate based on income and filing status. If the net result is a long-term gain, it will be taxed at a capital gains rate based on the investor’s income and filing status. A long-term capital loss can be used to offset ordinary income up to a limit of $3,000.

If an investor incurs a net yearly loss of less than $3,000, then he or she is able to deduct it from the regular taxable income and move on. If loss exceeds $3,000, an investor can deduct $3,000 from their regular income and carry the balance into the next tax year ($1,500 if married filing separately).

If your net loss was a combined short-term and long-term loss, you start applying the short-term loss first, carrying over any balance over $3,000 to next year along with your long-term loss.

Let’s consider the following hypothetical example. Say you just sold 1,000 shares of ACME Corporation (a fictitious company) for $120 each. You had purchased these shares three years ago for $100 each. The total long-term capital gain on the sale would be $20,000 {($120 x 1,000) - ($100 x 1,000)}. You also bought a piece of real estate this year for $325,000 and then had to immediately sell it for $300,000. This amounts to a short-term loss of $25,000 ($300,000 - $325,000).

This year you have a long-term gain of $20,000, a short-term loss of $25,000, and a net short-term loss of $5,000. Of that $5,000, you are only able to offset your regular income by $3,000, so $2,000 will carry over into next year as a short-term loss.

Suppose you had made a long-term gain of $25,000 and a short-term loss of $20,000. In this case, you have a net long-term gain of $5,000. To figure out how much you owe, we need some additional information such as your income and filing status.

Let’s suppose you file as single and you have $40,000 in ordinary income in 2022. For the long-term capital gains tax, income up to $41,675 doesn’t incur a capital gains tax, and income from $41,675 to $459,750 gets taxed at 15%. This means your first $1,675 of capital gains won’t be taxed, bringing you up to the $41,675 limit. The remaining $3,325 will be taxed at the 15% rate, meaning you will owe $498.75 in taxes ($3,325 x .15).

How do I minimize my capital gains tax?

Capital gains tax may be minimized by holding onto appreciating investments for longer than a year. The income thresholds for the long-term capital gains rate are similar to the ones for regular income. But tax rates are lower for long-term gains. This means it is usually in an investor’s best interest to be taxed at the long-term rate.

Another strategy is to wait for a year during which ordinary income is relatively low to realize capital gains. The lower the ordinary income, the lower the combined total ordinary and capital gains income. Since the capital gains tax tables use this total income to determine your tax obligation, realizing gains in a year in which you earned less than normal in ordinary income could result in a lower tax burden from your capital gains.

Additionally, you can use tax-advantaged accounts like (401(k)s) and Individual Retirement Accounts (IRAs) to protect your capital gains from being taxed. Capital gains that occur from buying and selling within these accounts (but not taking the money out) are not subject to taxation. Traditional IRAs and 401(k)s defer taxation until you start making withdrawals. Roth IRAs and Roth 401(k)s use money that was taxed before it was invested to grow tax-free and be withdrawn tax-free.

One more approach would be to strategically realize losses on investments you want to get rid of to offset realized gains. This strategy is known as tax-loss harvesting and is common late in the year as people seek out ways to lower their tax burden.

What are the capital gains rates in 2022 and 2023?

Short-Term Capital Gains Tax

An investor who owns shares or property for one year or less before selling for a gain falls into this category. The gain is taxed the same as regular income.

For an individual, these rates are as follows for 2022 (taxes due spring 2023) and 2023 (taxes expected to be due in spring 2024):

| Capital gains tax rate | 2022 Taxable income | 2023 Taxable income |

| 10% | $0 to $10,275 | $0 to $11,000 |

| 12% | $10,276 to $41,775 | $11,001 to $44,725 |

| 22% | $41,776 to $89,075 | $44,726 to $95,375 |

| 24% | $89,076 to $170,050 | $95,376 to $182,100 |

| 32% | $170,051 to $215,950 | $182,101 to $231,250 |

| 35% | $215,951 to $539,900 | $231,251 to $578,125 |

| 37% | $539,901 and up | $578,126 and up and up |

Long-Term Capital Gains Tax

Someone who holds stock or property for more than one year before selling for a profit will be deemed a long-term investor, and their tax rate might be significantly reduced.

For an individual, here's the breakdown of long-term capital gains tax rates for 2022 (taxes due spring 2023) and 2023 (taxes due spring 2024):

| Capital gains tax rate | 2022 Taxable income | 2023 Taxable income |

| 0% | $0 to $41,675 | $0 to $44,625 |

| 15% | $41,676 to $459,750 | $44,626 to $492,300 |

| 20% | $459,751 and up | $492,301 and up |

Net Investment Income Tax

Additionally, some individuals may also owe a Net Investment Income Tax (NIIT). The NIIT is a 3.8% tax that is applied to the smaller of an individual's net investment income or the difference between their modified adjusted gross income and the thresholds below:

- $250,000 for married filing jointly or qualifying widow(er)

- $125,000 for married filing separately

- $200,000 for all other cases

The rates and thresholds change frequently. So while calculating taxes, make sure you are using official IRS rates.

Capital gains and losses can be reported on Form 8949 from the IRS, and capital gains and deductible capital losses can be reconciled on Form 1040, Schedule D.

The information provided is not intended to be a substitute for specific individualized tax planning advice. Where specific advice is necessary or appropriate, seek consultation with a qualified tax advisor or CPA. Robinhood Financial does not provide legal or tax advice.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.