What is a Straddle?

A straddle is a trading strategy in which an investor buys a call option and a put option for the same security with the same expiration date and the same strike price.

🤔 Understanding straddles

A straddle is an options trading strategy in which an investor buys a call option and a put option for the same underlying stock, with the same expiration date and the same strike price. A call option allows an investor to buy an underlying security, such as a stock, at a predetermined price (strike price), while a put option allows an investor to sell that security at a fixed price. There are two types of straddles — long straddles and short straddles. Buying straddles work best when the stock market is volatile, and they have the potential to be profitable when the stock price either goes way up or way down. This strategy is not likely to be successful when the market is relatively stable, which can result in the investor losing the money spent on the options (known as the premium).

Let’s say fictitious Company ABC is planning to make an earnings announcement in a couple of weeks. Rob has been following the company and thinks the report will cause a considerable shift in its stock price. The problem is, he isn’t sure which way it’s going to move. Rob buys both a call option and a put option for Company ABC’s stock. In order for Rob to make a profit, the market price of the underlying stock must go up or down. At minimum, it should exceed what he spent on both options (his combined premium).

Takeaway

Buying a straddle is like leaving the house with both your sunglasses and your umbrella…

You’re pretty sure the weather is either going to be really good or really bad, but you aren’t sure which way it’ll go. So you’re prepared to make the most of the day either way.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.

How does a straddle work?

The purpose of a straddle is to profit from a significant shift in the price of a security, regardless of whether the price goes up or down.

Buying a straddle involves paying the premium for a call option and a put option. An option is a contract that gives someone the right to either buy or sell a security at a specific price (strike price) by a certain date. A call option allows you to buy securities at the strike price by the expiration date, while a put option allows you to sell them. In a straddle, the seller of the options expects the price of the underlying stock to be stable, while the buyer thinks it’ll go up or down significantly.

Let’s say that a security is trading at $100 per share. An investor buys a call option and a put option at $5 each, meaning the upfront investment is $10 total (the combined premium). Each option has a strike price of $100.

If the straddle falls within what’s known as the trading range, the investor doesn’t make a profit. The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. In the example above, with a $100 strike price and $10 premium, the trading range is $90 to $110. Within this range, the investor can’t do worse than lose $10 and can’t do better than break even.

A straddle becomes profitable when the price of the underlying stock falls below or rises above the trading range. In our example, the straddle would be profitable as soon as the value of the security went as high as $111 or as low as $89. In both cases, the investor would make a profit of $1 per contract. The further the stock’s price increased or decreased, the more the investor would profit.

If the price of the stock stayed exactly the same, both the put and the call option would be worthless — The investor would have lost $10. If the price fell or rose by $10 or less, the investor would have gotten some money back, but not made a profit. For example, if the stock price fell by $5, the investor could have gotten back $5 using the put option; the call option, on the other hand, would be worth nothing. If the price fell by $10, the investor would have gotten back the entire upfront investment without making any money. Keep in mind that these examples do not take into account commissions and other trading expenses.

As you can see, a straddle can be profitable if a stock’s price jumps or plummets. Investors often use this strategy when the stock market is particularly volatile or when they expect an important news event or earnings announcement to have a significant impact on a stock’s price, but aren’t yet sure whether the effect will be positive or negative. Of course, results are never guaranteed in investing, and it’s possible to lose money in a straddle.

What are the different straddle option strategies?

As with any options trade, there are always two sides to the equation — the buyer and the seller. In a straddle, one person is buying the options, hoping the price will shift. The other is selling the options, hoping the price will remain stable. The actions of the stock market determine which party in the transaction profits.

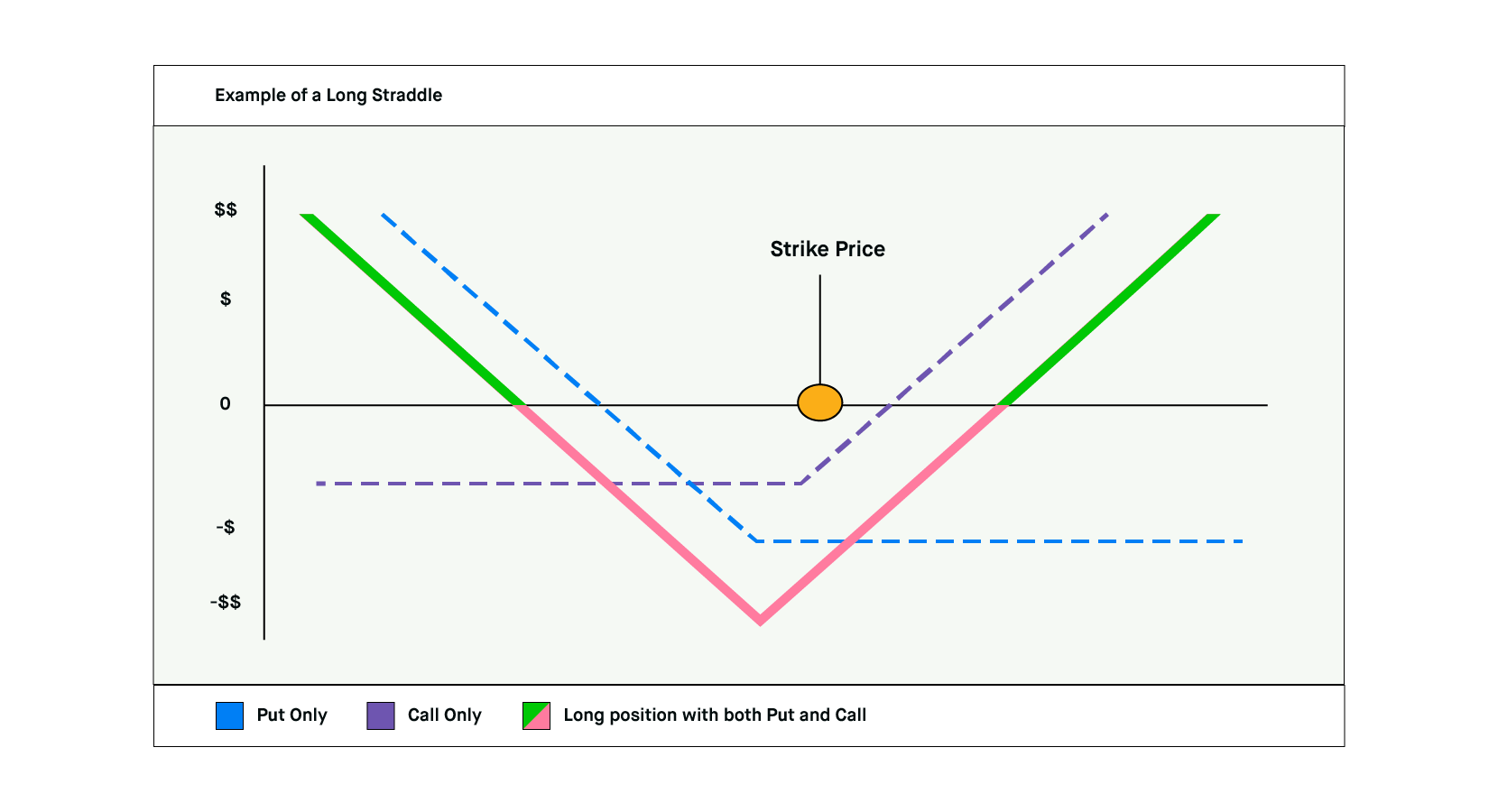

What is a long straddle?

A long straddle is when a trader buys a call option and a put option for the same underlying security, with the same expiration date and the same strike price. The option is profitable for the buyer when the value of the security shifts drastically in one direction or the other. The investor is hoping that the stock, or the market as a whole, becomes either bullish (experience a period of growth) or bearish (go through a period of decline).

With long options, the investor can only lose as much as he or she paid in premiums for the two options. Potential profit is unlimited.

What is a short straddle?

A short straddle is when a trader sells a call option and a put option for the same underlying security, with the same expiration date and strike price. The option is profitable for the seller when the value of the security stays roughly the same. The seller is hoping for no significant shifts in the security’s price.

Short options have a profit limited to the amount made from the sale of the options, while potential loss is unlimited.

Which has the most risk?

A short straddle has more risk associated with it. In a long straddle, the worst-case scenario is losing the money paid for the two contracts — the combined premium. For a short straddle, the worst-case scenario is unlimited, because the stock’s price could either crash or increase indefinitely.

What is a straddle vs. swaption vs. strangle vs. butterfly?

A straddle is not the only options trading strategy an investor can use to potentially make a profit. Remember, options trading involves contracts that allow the buyer to purchase a security at a set price by the expiration date. Swaptions, strangles, and butterflies are three other options strategies available to investors.

What is a swaption?

A swaption (also known as a swap option) allows an investor to enter into a swap agreement with the seller on a specific future date. A swap agreement is a contract that allows — but doesn’t require — one party to trade liabilities or cash flows from financial instruments with another. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. The two parties in the swaption are trading interest rates — namely, a floating interest rate (a variable interest rate that changes with the market) for a fixed interest rate.

Most participants in swaptions are big corporations, banks, or other financial institutions. A company that makes interest payments might enter into a swap in order to hedge its risk that floating interest will rise, causing its interest rate payments to rise. The company benefits from the swap if interest rates go up. The company takes over the lower fixed rate payments, while the other party takes over the floating interest rate payments.

What is a strangle?

Like a straddle, a strangle is an options trading strategy in which an investor can profit whether the price of a stock rises or falls, as long as the move is significant. They are also similar in that the investor buys both a call and put option for the same stock with the same expiration date.

There’s one key difference: With a strangle, the call and put options have two different strike prices, while in a straddle the strike prices are the same.

Again, an investor might buy a straddle when he or she is confident that the stock price will move significantly but doesn’t know in which direction. A strangle makes more sense when the investor is pretty sure the price will move in a certain direction but wants some cushion just in case.

Both strategies have unlimited potential for profit on the buyer’s part. Straddles can be advantageous because investors win regardless of which direction the stock price moves, as long as it’s significant. However, strangles can be cheaper to buy and may not require the security’s price to change as much in order to make a profit.

What is a butterfly?

A butterfly is an options trading strategy that involves buying four options contracts on the same underlying stock, all with the same expiration date, but with three different strike prices.

There are two types of call butterfly spreads: a long call butterfly and a short call butterfly. With a long call butterfly, the investor sells two options at a middle strike price, and buys one option at a strike price that’s lower than that and one with a strike price that’s higher. The upper and lower strike prices (wings) are both the same distance from the middle strike price (body). A short call butterfly involves the investor selling one option with a lower strike price and one at a higher strike price and buying two options at the middle strike price. The upper and lower strike prices (wings) are both the same distance from the middle strike price (body).

There are also two types of put butterfly spreads: a long put butterfly and a short put butterfly. With the long put butterfly, you sell two put options at a middle strike price and buy two puts with strike prices that are equidistant (one higher and one lower) from the middle strike price. A long put butterfly is profitable if the price of the stock remains at the middle strike price. In a short put butterfly, the trader buys two puts at the middle strike price and sells the puts with the higher and lower strike price. This strategy is profitable if the price of the stock is higher or lower than the wing strike prices at the time of expiration.

All butterfly options have a maximum possible profit and a maximum possible loss. An investor would use a different butterfly strategy depending on whether he or she thought the stock’s price would fluctuate significantly or stay roughly the same.

The above examples are intended for illustrative purposes only and do not reflect the performance of any investment. Investing involves risk, which means - aka you could lose your money.

Keep in mind options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. To learn more about the risks associated with options trading, please review the options disclosure document entitled Characteristics and Risks of Standardized Options, available here or through https://www.theocc.com. Investors should consider their investment objectives and risks carefully before trading options. Supporting documentation for any claims, if applicable, will be furnished upon request.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.