What is an Option?

An option is a contract that gives its owner the right to buy or sell a certain security, at a certain price, up until a certain date.

🤔 Understanding an option

An option is a contract that gives its owner the right — but not the obligation — to buy or sell an underlying asset. An option’s value depends on the price of the underlying security (e.g., a stock). An options contract might allow its owner to buy 100 shares of an underlying asset (that would be a “call”), or might allow its owner to sell 100 shares of an underlying asset (that would be a “put”).

You may also potentially profit from options trading by buying and selling contracts. This the most common way options traders attempt to profit from trading options. Options often expire with no value, so you should understand their risks before investing. Also, be aware some complex options might expose you to losses beyond what you paid or earned in your original transaction.

On August 1, 2023 Disney’s stock was trading at $89. If you are bullish on Disney and think the stock is going to rise, you could buy a call with an exercise price of $100 that expires December 15, 2023. That option cost $3.30, and since it gives you the right to buy 100 shares of Disney for $100 any time before December 15, 2023, it cost $330 (plus fees and commissions). That premium is your cost, and you hope that Disney’s price rises above $100. If it does, you could make a gain. If the price increases to $105 (for example), you could exercise the option, buying 100 shares for $100 each even though they’re worth $105. If the stock stays below $100 through the expiration, that option won’t have any value for you and you’ll lose the $330.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.

How does an option work?

An option is actually a legally-binding contract – it grants rights to the buyer and obligates the seller of the option to do certain things. The buyer gets the right to buy or sell, per the option contract, and since there’s value for that, the buyer pays the seller a premium. On the other side of the transaction, the seller has an obligation to buy or sell the underlying stock at a certain price, until a certain expiration date — that is, if the buyer exercises their rights under the contract.

Here are some key terms:

- __ Premium:__ The buyer of an option pays the seller a premium — this is the price of the option. The premium is often quoted as the price per share, but since most options contracts represent 100 shares of an underlying security, you’ll usually pay 100 times the per share premium for one option contract. For example, if an option has a premium of $1.00, you would need $100 to buy it.

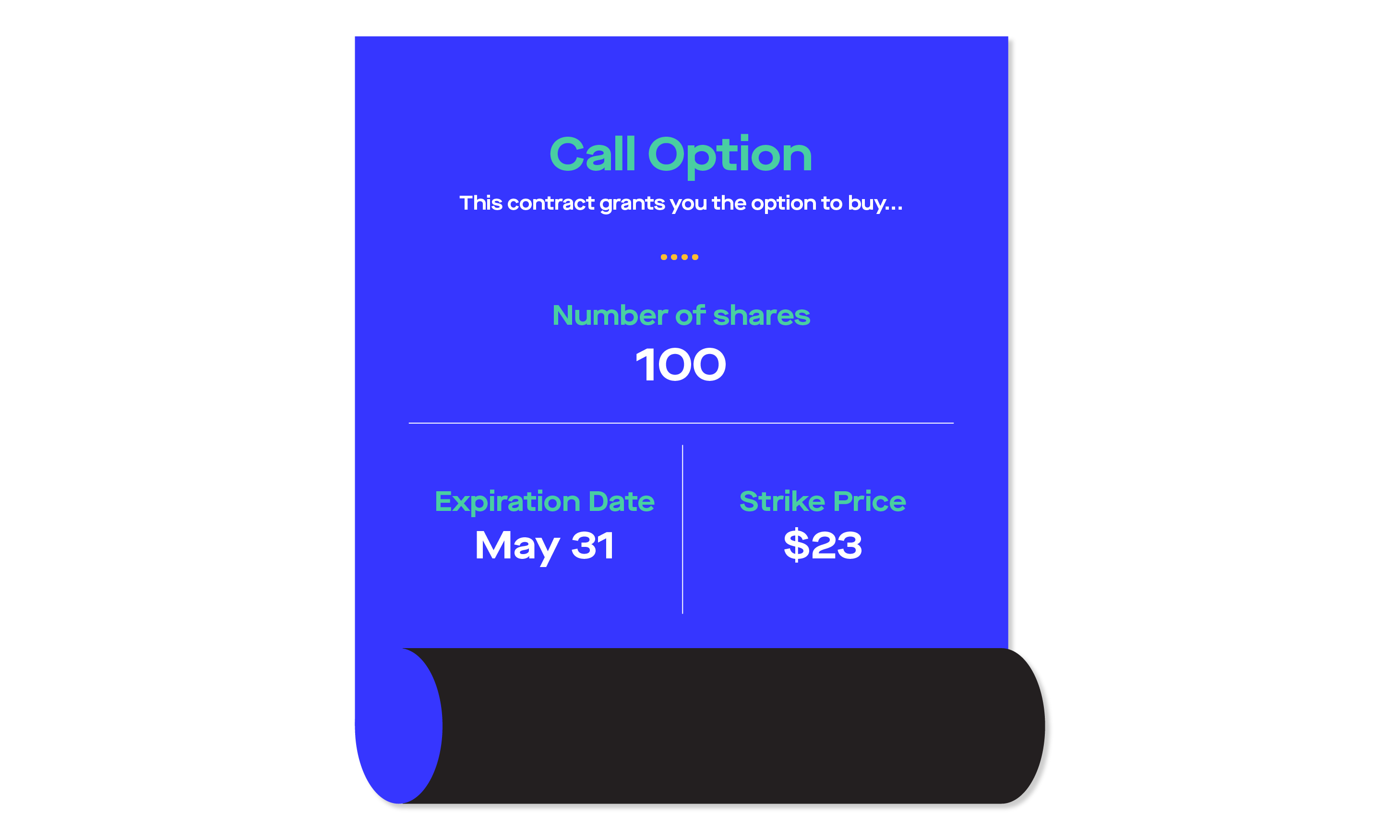

- Strike price This is the price the seller is obligated to to buy or sell at anytime through the expiration date of the contract. Strike price is also known as “exercise price.”

- Expiration date: Every option contract has an expiration date. This is the day the option expires and ceases to trade. For stock options, the “standard” expiration date is usually the third Friday of the contract’s end month. However, there are also “non-standard” options that expire every week, and for some products this can occur on days other than Friday.

The “call” option and the “put” option

There are two types of options: call options and put options.

- The owner of a call option has the right to buy a certain asset at a certain strike price until a certain expiration date.

- The owner of a put has the right to sell a certain asset at a certain strike price until a certain expiration date.

In the money, at the money, out of the money

Options can be in the money, at the money, or out of the money.

- In the money: When an option’s strike price is below the underlying asset price for a call, or above the underlying asset price for a put.

- At the money: When an option’s strike price is equal to the price of the underlying asset.

- Out of the money: When an option’s strike price is above the underlying asset price for a call, or below the underlying asset price for a put.

For a call option buyer, the value of the contract generally increases as the price of the underlying asset increases.

For a put option buyer, the value of the contract generally increases as the price of the underlying asset decreases.

However, keep in mind there are other factors that also can affect the price of an option.

How much value does an option have?

An option’s value is reflected by its price (aka its “premium”). As a retail investor, you just see the price of the option as a number shown on your brokerage platform. But it really has two components:

Intrinsic value + Extrinsic value = Price of option

- Intrinsic value: This is the amount by which an option is in the money. For example, take a stock that is trading for $55 and a call option with a strike price of $50 and a premium of $7. That option would have $5 of intrinsic value ($55 stock price - $50 strike price). For put options, it’s the opposite. Using the same stock trading at $55, the $60 put option would have $5 of intrinsic value. Intrinsic value means that if you were to exercise your option, there would be a built in gain from where you buy or sell the stock versus the current market value. However, don’t forget, just because an option has intrinsic value doesn’t mean you should or have to exercise your option.

- Extrinsic value: Extrinsic value is the amount of an option’s premium that isn’t intrinsic value. Using the above example, if the option is trading for $7 and has $5 of intrinsic value, then the remaining $2 would be the “extrinsic value.” If an option was out of the money, all of its premium would be considered extrinsic value. Extrinsic value consists of two factors: time value and implied volatility.

- Time value: Time value is the part of the price of the option that reflects the time remaining before expiration. The longer away the expiration date is, the more time the option has to potentially get into the money. For that reason, longer-dated options have more time value than shorter-dated options.

- Implied volatility: While it’s typically the hardest concept for new options traders to grasp, implied volatility can greatly affect an options price. The more volatile a stock is (the range of a stock’s price over a specific period of time), the greater the chance an out of the money option has to become in the money before expiration, and therefore the more value an option will have. Think of implied volatility like the market’s best attempt at a crystal ball – an expectation for volatility expressed in the option’s premium based on supply of and demand for the options. It’s called implied volatility because it is derived from the options price. If traders think the stock is going to move, options will be priced higher. If traders think the stock’s price will remain stable, then options tend to be cheaper. But, as with any crystal ball or forward looking indicator, it can and will be wrong from time to time. The takeaway here is that implied volatility is always rising and falling and this can increase or decrease the value of options independent of what the underlying stock is doing (going up or down).

What the owner of the option can do?

If you own an option, there are a number of things you may do:

- Sell it prior to the expiration date: Options have value that change day to day, driven primarily by the underlying stock price, their time to expiration, and implied volatility (there are other factors as well). The value is reflected in the premium, and you can submit an order to sell your option prior to its expiration. The difference between how much you paid for the option and how much you’re selling it for is your gain or your loss. This is the most common way options traders close their position.

- Exercise it prior to the expiration date: American style options can be exercised any time before the expiration date, while European style options can only be exercised on the expiration date. Typically, you would only exercise your options if they are “in the money,” and you wish to buy (in the case of a call option) or sell (in the case of a put option) the underlying shares of the stock. This also assumes you have the cash to buy 100 shares of the underlying, or own 100 shares of the underlying. (Note: exercising a long put when you don’t own the stock will result in a short stock position. This is only allowed in certain brokerage accounts, and with special trading permissions. It is not allowed at Robinhood).

- Let it expire: If the option is out of the money at expiration you can also let it expire worthless. Most brokerage firms will remove the position from your account during the weekend after expiration.

- Roll your position: Rolling is the process of closing your existing position and immediately re-establishing it at another expiration, and sometimes with a different strike price. While some traders utilize this method to “extend duration” of their trade, ultimately you are closing one postion, realizing any gain or loss, and opening a new one.

Note: Your brokerage firm most likely has a policy of exercising options for you if they are in the money by one penny or more on expiration day. Check your brokerage firm’s specific policies and procedures.

Also, be aware of any option in your account where the underlying stock is hovering around the strike price on expiration. You may think an option is about to expire worthless, but trading activity into and after the closing bell could swing your option into the money. This would result in your option being exercised. This is called “pin risk.” The best way to avoid pin risk is to close any options that might have a chance to be in the money before the closing bell on expiration.

Risks of investing with options

When it comes to options, you can be the buyer or the seller.

As the buyer of an option, your theoretical risk is limited to just the premium that you paid. The worst case is that the option expires out of the money, worthless, and you lose the entire amount you paid for the option (although this can change if you exercise your option). The best case is that the option moves into the money and you make a gain and sell it back for a profit.

As the seller of an option, your risk is more open-ended. If you sell a contract, you’re hoping that it expires worthless. In that case, your profitis the amount of the premium you collected for selling the option. If you’re assigned on your option, you will be obligated to buy or sell a stock, thereby taking on more risk.

- If you sell a call, for example, your potential loss is unlimited, as the underlying stock price could increase infinitely high. If the stock rises very high, you are obligated to sell the stock to the buyer of the option at the exercise price. Although you made some money (the premium) by selling the option, you could lose a lot more by having to sell the stock to the option buyer at an exercise price that’s much less than the market value.

- If you sell a put, your potential loss is limited to the strike price of the put option, minus the premium you collected for selling the put option. That’s because the stock price could go to zero, but as the seller of a put you’re obligated to buy stock from the put owner at the strike price. The difference between the stock price and the strike price is your loss (which will be offset partially by the premium you collected at the beginning).

It’s important to understand that as the seller of an option, your risk is potentially unlimited if you sell a call, and potentially very large if you sell a put. As a buyer, your risk is that your option expires with no value, and you lose the entire premium you paid with nothing to show for it. As with any option you buy or sell, if you exercise a long option, or are assigned on your short option, your potential risk then changes because you now own or are short shares of stock.

Options transactions may involve a high degree of risk and it's not appropriate for all investors. Certain complex options strategies carry additional risk. Please review the options disclosure document titled Characteristics and Risks of Standardized Options available here to learn more about the risks associated with options trading. Investors should absolutely consider their investment objectives and risks carefully before trading options.

How can I buy an option?

Options are available to certain retail investors through brokerage companies, like Robinhood.

You buy an option for a premium. The cost to you is the premium (remember that premiums are often quoted as a per-share price, but are sold in contracts of 100 shares. So a $0.30 premium would cost $30, since it’s good for the right to buy or sell 100 shares of the underlying asset) plus any commissions and fees your brokerage charges. Note: Robinhood does not charge commissions (Other fees may still apply. Please see Robinhood Financial’s Fee Schedule here) .

What are the uses of options?

- To help limit your risk (aka to “hedge”): For example, if you buy a stock, you think the price will rise. You could be wrong though. To protect yourself from loss if the stock price falls, you could buy a put. The put option helps to define your max loss on your investment. It’s important to note there are a number of strategies and ways to use options to hedge against risk in your portfolio, buying a put is just one example.

- To generate income: You could sell options (or options spreads) to generate extra income. The premiums you earn are income. But there’s always the chance that the options you sell gain in value, leading to a loss, or assignment. Once again, assignment will expose you to risk of being long or short shares of stock.

- To speculate: You may think that a stock will rise or fall over a certain period of time. Instead of buying the stock or selling it short, you could buy a call or buy a put (among other strategies). Buying options has a smaller upfront cost than owning or shorting the stock outright, but are generally considered lower probability strategies, meaning, the odds of making a profit is not in your favor.

Examples are hypothetical, and do not reflect actual or anticipated results, and are not guarantees of future results. Supporting documentation for any claims, if applicable, will be furnished upon request.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.