What is a Bond Yield?

Bond yield refers to the amount of interest an investor earns annually, expressed as a percentage of a bond’s price.

🤔 Understanding bond yield

When you buy a bond, the amount of money in interest payable to you is a percentage of the bond's issue price. That amount of money never changes. When bonds are traded, their market value can change. When their market value changes, the amount of money payable to you now represents a different percentage of the market price. This is a bond's yield.

If you own 10 marbles out of a stash of 100 marbles, you could say you own 10%. But what if the stash of marbles increases to 200? Would you still own 10%? No. You would still own 10 marbles, but now you would own 5% of the stash. This is how bond yields work. When bond prices rise, bond yields drop, and vice versa.

Netflix has gone through several bond offerings over the years to raise billions of dollars to acquire media content and grow its company. On February 5, 2015, the company issued a total of $800 million worth of 10-year bonds called the NETFLIX 2025. These bonds have a face value of $100 and a coupon rate (interest payable) of 5.875% which is equal to about $5.88.

On October 15, 2019, the bond yield for NETFLIX 2025 was 3.31%. This means that the NETFLIX 2025 bond was trading for more than the face value of $100 on the bond market. Investors who wanted to buy this bond on October 15, 2019 would’ve had to pay about $111 instead of the face value (original price) of $100.

Takeaway

Comparing bond yields is like shopping for a new TV...

There are a lot of factors to consider when you shop for a new TV. How big is the screen? Is the picture quality high-definition, or maybe 4K? Perhaps it’s a smart TV, and you can connect it to your favorite streaming service.

You probably want to get the most bang for your buck, but you also want to make sure that you make the right tradeoffs. Similarly, bond yield is just one factor to consider when investing. You might also consider the issuer (like the TV’s manufacturer), their creditworthiness (kind of like the TV’s warranty), and term to maturity (sort of like how long you expect to have the TV). Whether you’re buying a new plasma screen or a Treasury bond, you should take time to figure out if your purchase is the best use of your money. Bond yield may give you some insight into a potential investment.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.

- What is a bond yield?

- What does it mean for a bond to trade at a premium?

- What does it mean for a bond to trade at a discount?

- What’s the difference between coupon rate and current yield?

- What causes bond yields to rise or fall?

- Can you lose money investing in bonds?

- What is a bond’s rating?

- How can inflation affect bond yield?

What is a bond yield?

A bond is basically an agreement to loan money to a company or government entity.By issuing a bond, a borrower agrees to pay back the original loan amount (aka the “principal”) at a fixed future date (the bond’s maturity date), plus make regular interest payments. The interest payments, also known as coupons, are usually paid annually, semi-annually, or at another regular interval.

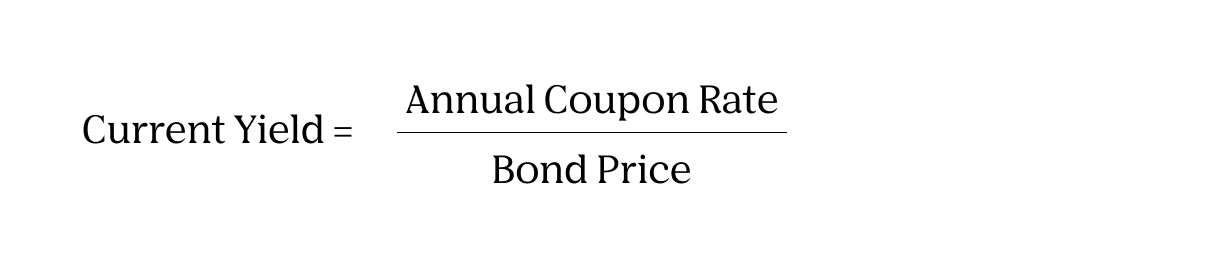

Investors typically calculate bond yield to estimate how much they could earn on their initial investment through interest payments. Bond yield is usually expressed as a percentage of the original investment (the coupon rate) or as a percentage of the bond’s current market price (the current yield).

Let’s take a closer look:

Coupon rate (aka coupon yield): Let’s say you bought a bond for $5,000, and the bond pays you $200 in interest annually. Here’s how to calculate your coupon rate:

Coupon Rate = Annual Coupon Payment / Face Value of Bond

$200 / $5,000 = 0.04 x 100 = 4%

So, your coupon rate is 4%.

Current yield: However, let’s say that you didn’t buy the bond when it was first issued for $5,000. Maybe you bought it on the secondary market, and paid a premium (let’s say $5,500, or $500 more than its original price). Here’s how you might calculate the bond yield under those circumstances:

Current Yield = Annual Coupon Payment / Current Market Price of Bond

$200 / $5500 = 0.0364 x 100 = 3.64%

In this case, your current yield would be 3.64%.

A bond’s coupon and current yield are helpful when looking at a particular moment in time. But bond yield can change over the course of a bond’s life, depending on the bond’s price, interest rates, and other factors. To get a more complete picture of bond yields, there are several other formulas worth knowing about:

Yield to maturity (YTM) estimates the overall interest rate an investor earns if they hold the bond until it matures (that’s when the issuer repays the principal). This formula helps you approximate a bond’s YTM:

YTM = (C + (FV - PV)/T) / ((FV + PV)/2)

Where: C = The bond’s interest or coupon payment FV = The bond’s original face value (or par value) PV = The bond’s most recent market price, or present value T = How many years it will take for the bond to mature

Keep in mind this formula allows you to estimate a bond’s YTM, as its actual current market value is in flux.

Yield to call (YTC) is similar to YTM, but it factors in the possibility that the bond issuer may retire the bond (aka call the bond) before it matures. The formula to estimate YTC is similar to that for YTM, except you use the bond’s call price and number of years until the bond is called.

YTC = (C + (FV - P)/T) / ((FV + P)/2)

Where: C = The bond’s interest or annual coupon payment FV = The bond’s original face value (or par value) P = The bond’s call price T = Number of years until the bond was called

Yield to worst (YTW) compares the YTM and YTC and uses whichever figure is lower. YTW is one way of estimating the most conservative potential return a bond may provide.

What does it mean for a bond to trade at a premium?

If you sell your bond at a higher price than what you paid, that’s called trading at a premium. A bond’s price can rise or fall depending on a variety of factors. One example is a change in the interest rates.. Let’s say you own a $2000 bond with a 5% coupon rate. A few years later, interest rates might have fallen to 3%, and now many new bonds on the market only offer a 3% coupon. You decide to sell your bond. Because your bond’s 5% interest rate is higher than the 3% offered by newly-issued bonds, your bond is likely more appealing to buyers — And thus it’s likely that you can sell your bond at a higher price than you originally paid. This is called trading at a premium.

What does it mean for a bond to trade at a discount?

Trading at a discount is the opposite of a premium — It’s when you sell your bond at a price lower than what you originally paid. Imagine another scenario where you bought a $1000 Treasury bond with a 3% interest rate. One year later, interest rates have gradually risen by 1%. When the Treasury puts up new bonds for auction, they might offer a higher coupon rate of 4%. If you were to sell your bond, now it may be less appealing to buyers, so you might have to sell at a lower price than you originally paid, or at a discount.

What’s the difference between coupon rate and current yield?

A bond yield is often expressed in two ways:

- Coupon rate, aka the bond’s interest payment as a percentage of the original investment. This interest rate is fixed at the time the bond is issued, and remains the same throughout the lifetime of the bond.

- Current yield, aka the interest payment as a percentage of the bond’s current market price. Unlike coupon rate, a bond’s current yield can change over time depending on the bond’s market price, which fluctuates depending on market conditions, a change in federal interest rates, and other factors.

What causes bond yields to rise or fall?

Remember that a bond’s current yield represents the share of the interest payment compared to the bond’s current market price. While the interest payments usually stay the same throughout a bond’s lifetime, the share they represent can change if the bond’s market price rises or falls from its original value (aka par or face value).

Changes in bond prices tend to follow a cardinal rule: When interest rates fall, a bond’s price rises, and when interest rates rise, bond prices fall. This is because higher interest rates often mean that an investor can receive larger interest payments on a newly issued bond. This makes existing bonds, with relatively lower interest rates, less appealing. (That’s why their prices might fall.)

Let’s say you buy a 10-year note today at an interest (or coupon) rate of 5%. Your initial investment is $1,000. A few years later though, the interest rate on new, 10-year notes rises to 6%. If you decide to sell your bond, there may be less demand for it because there are newer bonds, offering a higher interest rate.

That said, interest rates aren’t the only factor that can cause a bond’s price (and thus, its yield) to change. Others include:

- Changes in the bond’s supply or demand

- Changes in the bond issuer’s creditworthiness, depending on their financial health, economic market conditions, or other factors

- If the issuer calls the bond (retires the bond before it matures)

Can you lose money investing in bonds?

Bonds are generally considered less risky than some other types of securities, such as stocks. But like all forms of investment, bonds carry risks. There are several ways an investor might lose money in bonds. For example:

You sell your bond on the market for less than you paid for it (aka at a discount). Investors who hold the bond until it matures should, in theory, get their initial investment back, in addition to the periodic coupon payments they’re paid over the life of the bond. However, that’s not always the case. If you need to sell your bond before it reaches maturity, you may suffer a loss.

It’s possible that the issuing entity might stop making interest payments on your bond. For instance, if the company that issued the bond faces financial troubles, it’s possible for them to fail to make interest payments, or to default.

Not all bonds reach maturity: In some cases, the bond’s issuer may retain the right to redeem a bond before its term is up. (These are known as callable bonds.) As with any investment, it’s important to do your research ahead of time to understand the risks and how you might mitigate them.

What is a bond’s rating?

Like an individual borrower’s credit score, many bonds and bond issuers are assigned ratings based on their overall creditworthiness (a measure of the borrower’s ability to repay their debt). A bond’s rating helps investors understand the likelihood that the issuer will pay back the loan in full. There are special credit rating agencies designated for this job by the Securities and Exchange Commission (SEC) — They’re known as the Nationally Recognized Statistical Rating Organizations (NRSROs).

These agencies review the overall financial health of many (though not all) bond issuers. The agency then assigns the bond a rating, or a letter grade, ranging from AAA or Aaa to D or no rating. Bonds generally fall into two categories:

- Investment grade includes bonds that are rated BBB, bbb, Baa, or higher. These are generally considered relatively low or moderate risk.

- Non-investment grade bonds, also known as junk bonds or high-yield bonds, tend to carry a much higher risk that the issuer may default.

Keep in mind that each NRSRO agency uses its own set of criteria, so a bond rating can vary from one agency to the next.

How can inflation affect bond yield?

Generally speaking, inflation has a similar effect on bond yield as interest rates do. Remember the cardinal rule of bond prices: When interest rates fall, a bond’s price rises, and when interest rates rise, bond prices fall. When inflation goes up, interest rates often rise, too — and thus bond prices go down, which can lower the bond’s current yield.

Bonds with a longer maturity (aka due further in the future) may be more likely to see a price drop, because there’s more time in which inflation may spike. This may be one reason why some bonds with longer maturity offer a higher interest rate than other bonds.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC.